A Siren Call About Market Rallies and Profits!

Every time the markets heat up, in my friends’ group the inevitable question crops up:

“Should I book profits?”

Last time this happened few months ago – I think it was July or August when the Sensex was within kissing distance of 68000 – I thought I had given a reply that I thought was acerbic enough to scotch any future discussion on the question (I even wrote an article about this at that time). But the notion of “Booking Profits” is so powerful that that question refuses to die. It cropped up again yesterday when the Sensex reached new heights.

What is funny (and infuriating too) about it is that the sequence of questions and answers was the same as before:

“My investments have appreciated wonderfully well, should I book profits while the values are on a high and cash in the gains?”

My response too was the same as before:

“Surely, if you need the cash immediately to fulfill some purpose, of course now will be a good time by redeeming your investments. BUT what do you plan to do with that cash?”

His response too was the same as before:

“Nothing. I don’t really need that cash right now. I will just invest it back and wait for the next rally to book even more profits.”

I said “Look I don’t know whether to laugh or to cry. We went over exactly this same conversation 6 months ago and I thought I had explained to you that you will gain nothing out of this other than a fleeting sense of triumph at “Having Made Money” but let me explain it once again with a very different perspective than last time”.

Firstly, this whole process of “Book Profits >> Reinvest and wait for next rally >> Book even more profits and keep doing it” will work If and Only if at every reinvestment step you are able to invest at a lower level than you sold for (market timing) or if you are able to find investments that have not appreciated before despite the market rally. For the context of this post, we will leave market timing and compounding aside, as I have addressed this before.

If, however the investments you wish to reinvest in are already at a high (which is more likely if the market rally is a broad-based rally i.e., you see the rally precisely because most investments have gone up) then your expectation of “investing at lower level and using the next rally to book even more profits” is unlikely to be true!

So, you must find something which DESPITE the rally has not increased in value significantly (but will do so in the future). The question then is when everything is going up, why is this particular investment a laggard? Often, the answer is that the stock market expects this stock to do poorly in the near future. Therefore, most traders and investors are staying away from it. I am not in any way suggesting that this might be a bad investment or that this investment might not go up. I am simply making a point that it is super difficult if not impossible to make such judgements and predictions even after a rigorous analysis. Of course, if you search hard enough and diligently enough it is possible to find something that is of good quality and yet has not rallied up in sync with the overall market for some unrelated reasons and” therefore can hopefully provide you the opportunity to “Buy low and book even more profits”.

That’s how traders hope to make money! Majority of them however do not make the money they hope for. And remember they are in the business of stock trading (it’s a full-time business in itself).

BUT let’s look at your investments and your investment behavior in the past.

- ALL your investments are in mutual funds and not directly in individual stocks!

- You have often declared that you will never invest directly in stocks because you are afraid of taking the risks of market ups and downs and do not have the skill or wish to spend the time and effort that is required to do the research to ascertain the quality of investments.

Your investments are like a garden you’ve entrusted to a professional gardener—your mutual fund manager. You’ve chosen not to plant the seeds yourself because you know it takes constant care, knowledge of the seasons, and an understanding of which plants will thrive.

The professional gardener knows when to water, when to fertilize, and when to harvest. If you try to do their job without their expertise, you might end up pulling out the flowers before they bloom or watering too much during a downpour.

Remember, the goal of your mutual fund is to grow steadily over time. It is the roots which give a tree strength not its branches or leaves or fruits…And a small tree with strong roots will outlive a big one with weak roots. Therefore, the secret in investing is always time and compounding. It’s like a slow-cooking pot roast—patiently waiting for it to cook fully brings out the best flavors. Jumping from one investment to another looking for quick gains is like constantly opening the oven to check the roast; it only slows down the cooking process.

By staying invested in mutual funds, you’re choosing the peace of a well-maintained garden or the satisfaction of a meal that’s been given time to develop its full flavor. The mutual fund managers are your expert chefs and gardeners. They have the tools, the time, and the know-how to make the most of market conditions, so you don’t have to worry about when to buy or sell. An important thing to remember is that real investing is not about buying and selling…It’s about owning a portfolio of great companies, managing risk by diversifying across companies/sectors and then letting these companies work for you by behaving like a responsible owner.

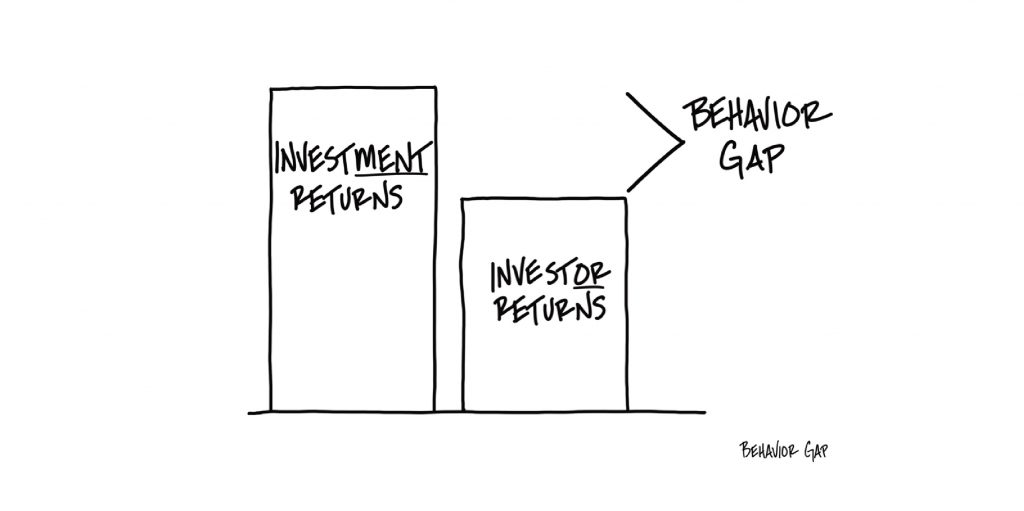

Remember the late Charlie Munger’s first rule of compounding is to never interrupt it unnecessarily. Because of the way compounding works, booking profits is likely to ensure that you forgo a substantial part of your upside (overall profits). While Booking Profits sounds intellectual (or wise), at its core it is yet another manifestation of market timing. You sell high and buy higher, over and over again. Some even buy 30-100% higher after frustratingly waiting for a correction to enter. And it’s that repeated behavior that leads to the difference between investment returns and investor returns.

and then tap on

and then tap on

0 Comments