There Is No Average Return

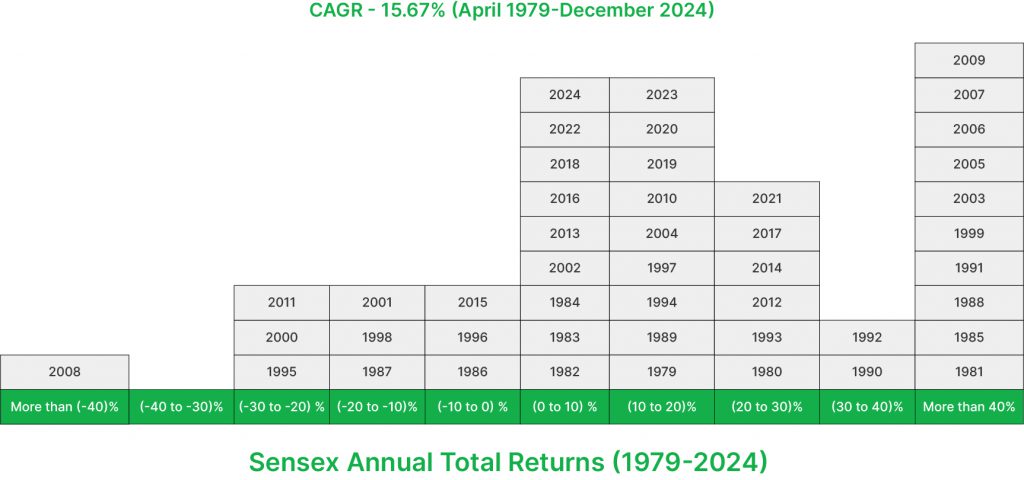

The Sensex has delivered an average annual return of 15.67% since 1979.

That number looks great.

But here’s the problem—this is not how it actually plays out.

There is no such thing as an “average return” in the way most investors think about it.

You will never see the market giving you exactly 15.67% in any given year.

Some years, it will go up 40%.

Some years, it will go down 30%.

Some years, it will barely move.

Look at the history of returns. The Sensex has had wild swings.

2008 saw a crash of more than 40%.

2009 saw a rally of more than 80%.

There were years when the market went nowhere.

There were years when it surged past expectations.

The idea that you will get a smooth, predictable 15.67% return every year is an illusion.

Yet, many investors think this way.

They expect steady returns, and when the market doesn’t behave that way, they panic.

They forget that the long-term average is made up of extreme short-term fluctuations.

This is why so many people make mistakes.

They expect a smooth ride when investing is anything but smooth.

Investing does not reward those who chase consistency.

It rewards those who can handle volatility and stay invested.

The only way one could have got the long-term return of 15.67% was to go through all the unpredictable ups and downs along the way.

If you sell when the market falls, you destroy your ability to earn this return.

If you wait for perfect conditions, you miss the best days.

If you try to time the market, you end up making more mistakes than good decisions.

The reality of investing is simple.

You will have great years.

You will have bad years.

But over time, if you stay invested, the long-term trend is up.

The market rewards patience.

It rewards discipline.

It rewards those who understand that the average return is not something you get every year, but something you earn over decades.

The longer you stay, the more predictable your returns become.

But in the short term, anything can happen.

This is what separates investors from speculators.

Speculators get shaken by short-term volatility.

Investors embrace it.

Speculators chase what’s working now.

Investors know that staying in the game is what really works.

Speculators think in days, weeks, and months.

Investors think in years and decades.

The problem is that most people want long-term returns but don’t want to deal with short-term uncertainty.

They want the upside without the downside.

They want returns without patience.

But that’s not how markets work.

If you want to see the magic of compounding, you need to be prepared for temporary declines.

If you want to build wealth, you need to accept that some years will be bad.

You need to stop expecting the market to behave the way you want it to.

Instead, understand how it actually behaves.

Look at history.

The market has always recovered.

Not once has a downturn been permanent.

Not once has the long-term trend reversed.

But every downturn has shaken out impatient investors.

Every panic has made people sell at the worst possible time.

And every bull market has rewarded those who stayed.

This is why long-term investors win.

They don’t fall for the myth of “average returns.”

They know the journey is unpredictable.

But they also know where the journey leads.

The destination is always higher.

The long game is undefeated.

and then tap on

and then tap on

0 Comments