The Random Stranger

Imagine someone comes up to you on the street and asks for a large sum of money. You don’t know this person. You don’t know their intentions, their background, or what they’ll do with your money. Would you give it to them? Probably not. In fact, no rational person would. We protect our wealth and ensure that it’s used wisely. Yet, in the stock market, this exact scenario plays out every day.

When investors panic and sell their stocks during market declines, they are effectively handing their money over to someone else—a stranger. This stranger is the person on the other side of the transaction, and they are buying what you are so desperate to sell. Think about that for a moment: when you panic sell, someone is there to buy. And that person isn’t buying in fear; they’re buying in anticipation of future gains. By selling in panic, you’re enriching this buyer, often at your own expense.

The Paradox of the Market

The stock market is a marketplace of emotions. It’s a place where fear and greed collide, and where decisions are often made based on emotions rather than rational analysis. When markets decline, fear takes hold. Investors start to see their portfolios drop, and panic sets in. Headlines scream of economic doom, and social media amplifies the anxiety. The instinct is to act—to do something to protect what’s left.

And the easiest action? Sell.

But here’s the paradox: when you sell in panic, someone is buying with confidence. They are buying your investments at a discount, taking advantage of the very fear that’s driving you to sell. They know something you might not: that market declines are temporary, and opportunities often lie in the moments of greatest fear.

The Real Cost of Panic Selling

When you sell in fear, you’re not just losing money temporarily. You’re locking in those losses. And worse, you’re handing those losses over to someone else who sees value where you see risk. Panic selling isn’t a strategy; it’s a reaction. And reactions, especially emotional ones, rarely align with long-term wealth-building.

Consider this: when you sell during a market dip, you’re essentially giving away ownership in quality businesses. These are businesses that have weathered storms before, that have strong fundamentals, and that, in many cases, will recover and grow even stronger. By selling, you’re transferring your stake in these businesses to someone else—someone who believes in their long-term value and is willing to wait. You’re giving away the future gains that would have been yours, all because of a temporary emotional response.

The Stranger on the Other Side

The person on the other side of your panic sale is not necessarily more knowledgeable than you, but they are likely more disciplined. They understand that markets go through cycles. They understand that declines are temporary. They’ve seen declines before and know they are a natural part of the investment journey. When they buy, they aren’t thinking about the short-term noise; they’re thinking about the long-term value they’re acquiring.

They know that a stock’s price doesn’t always reflect its true worth, especially during periods of panic. So, when prices fall, they see opportunity. They’re buying what you’re selling because they understand the concept of value over price. By selling to them, you’re handing over the opportunity for future growth. You’re enriching them at your expense.

Why Do We Do It?

Why do intelligent investors, who know the basics of investing, fall into this trap? The answer lies in human psychology. We are wired to respond to fear. It’s a survival mechanism. When we see danger, we react. In the stock market, that danger comes in the form of red numbers, declining prices, and a sense of losing control. It’s not that we don’t know this. But we can’t do much about this on our own.

The media and social platforms amplify these fears. They fill our screens with stories of market crashes, economic recessions, and looming financial disasters. The message is clear: get out now or lose everything. Faced with this barrage of negativity, even the most disciplined investors can feel the urge to act, to do something, to protect what’s theirs. And often, that action is selling.

But here’s the catch: reacting to market noise is almost always a mistake. The market is unpredictable, and short-term fluctuations are inevitable. By selling in panic, you’re trying to predict what will happen next. And no one, not even the experts, can consistently predict the market’s next move. When you sell based on fear, you’re betting against the market’s long-term growth—historically, a losing bet.

The Opportunity in Fear

The truth is, the stock market rewards those who can stay calm when others are losing their heads. The greatest investors understand this. They know that when fear is high, prices are often lower than they should be. They don’t see declines as threats; they see them as buying opportunities.

When others panic and sell, they buy. They know that in the long run, markets recover. Economic cycles are just that—cycles. After every decline comes recovery, and those who have the courage to buy during downturns or just stay put often see significant gains when the market rebounds.

How to Avoid Giving Away Money

If you don’t want to hand your money over to a stranger, you need a strategy that keeps you grounded, even in the most volatile markets. Here’s how:

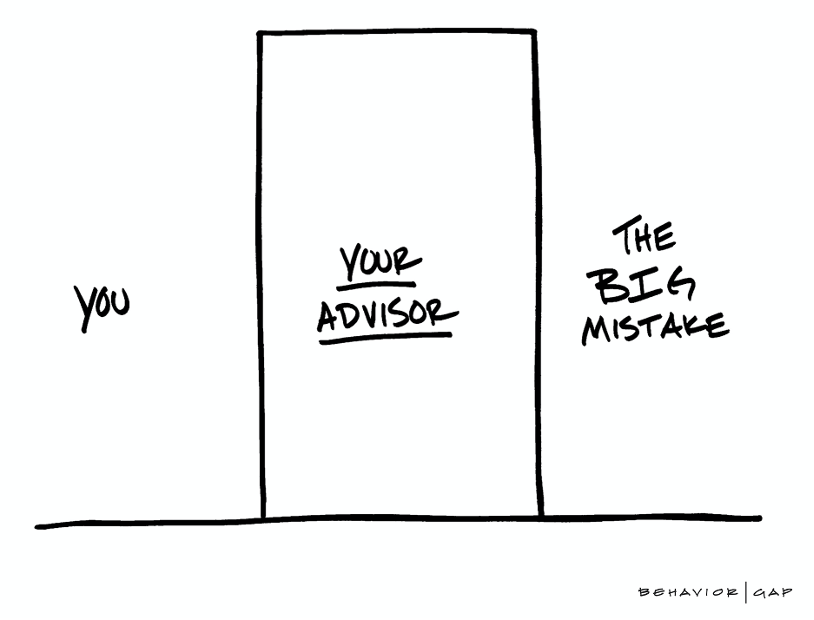

Get a Real Financial Professional to Come Between You and the Stranger

When fear grips the market, emotions can cloud judgment. It’s at these moments that having a real financial professional by your side can make all the difference. They act as a buffer between you and impulsive, emotionally driven decisions. Think of them as the calm voice of reason when chaos seems to dominate your thoughts.

A real financial professional is not just someone who allocates your money. They are someone who understands you—your goals, fears, and the dreams you have for your wealth. Their job is to bring objectivity to the table. When market volatility stirs up panic, they help you stay anchored to your long-term strategy.

Here’s why they’re essential:

- Perspective: A real financial professional knows that market downturns are inevitable. They’ve seen them before and understand that they are part of the investment journey. They’ll remind you of the bigger picture—why you started investing in the first place and what you stand to gain by staying the course.

- Discipline: Emotional reactions can lead to rash decisions, like panic selling. Financial professionals ensure that your actions align with your plan. They stop you from succumbing to fear and making choices that hurt your long-term wealth.

- Data-Driven Decisions: Professionals rely on facts, not emotions. They analyze the market, your portfolio, and your financial objectives to provide recommendations based on evidence and logic, not headlines or hearsay.

- Customized Guidance: A real financial professional tailors advice to your unique situation. They help you navigate the turbulence by focusing on your specific goals, rather than following generic advice from the media or “finfluencers.”

- Guarding Against the Stranger: That stranger on the other side of your panic sale is looking for an opportunity—your loss is their gain. A financial professional ensures you don’t become their victim. Instead of selling, they might guide you to see downturns as opportunities to buy quality investments at discounted prices.

Having a real financial professional is like having a coach for your financial journey. They don’t just protect you from mistakes; they also empower you to make better decisions. With them in your corner, the temptation to hand over your money to a stranger diminishes. Instead, you stay focused on what truly matters: growing and preserving your wealth for the future.

The Next Time You Feel the Urge to Sell

Ask yourself: am I about to give my money away to a stranger? Remember that every panic sale enriches someone else—someone who is willing to buy what you’re selling at a discount. They’re betting on the market’s recovery, and they’ll likely reap the rewards. Instead of handing over your money, take a deep breath, revisit your plan, and remind yourself why you’re invested.

If you can’t resist the urge to act, then consider buying more of the quality investments you already own. Or simply do nothing—sometimes the hardest, but best action is inaction. Let the market do its thing while you stick to your strategy.

Keep Your Money

The stock market can be an emotional place. It tests our resolve and plays on our fears. But the investors who succeed are those who learn to stay calm, see opportunities in declines, and refuse to hand their wealth over to strangers.

Build a plan, stay disciplined, and trust in the long-term growth of the market. This way, you can ensure that you’re not just handing over your money during the next market downturn. Instead, you’ll be positioned to grow your wealth while others give theirs away.

Investing is a game of patience and discipline. Those who play it wisely come out ahead. Don’t let your emotions be the reason you enrich someone else.

The question then is: Will you let this random stranger win?

and then tap on

and then tap on

0 Comments