Finding Peace in Your Financial Life

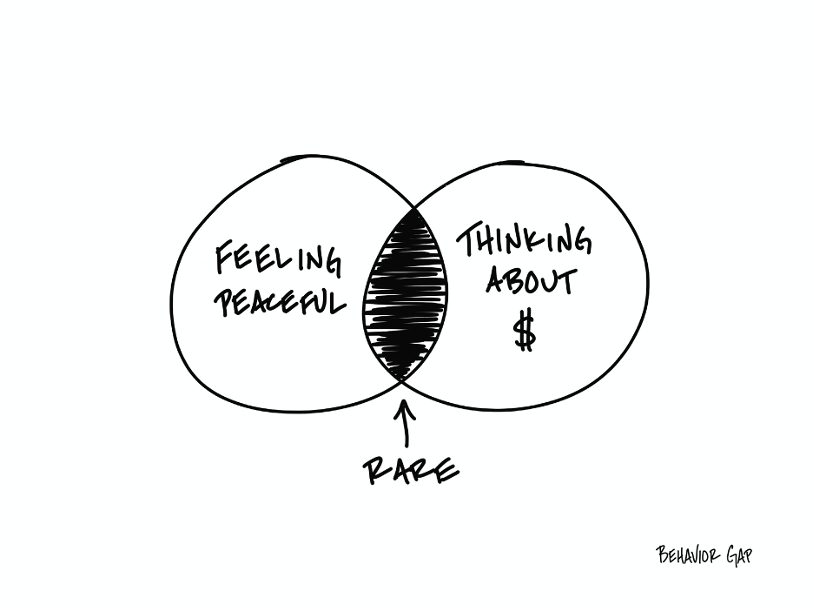

When was the last time you thought about your money and felt truly peaceful? If you’re like most people, the answer is probably “rarely, if ever.” And that’s the core issue.

The image says it all. Most of us live in two worlds when it comes to money: either we are actively thinking about it, often feeling stressed, or we’re not thinking about it at all and hoping everything turns out fine. The intersection between thinking about money and feeling peaceful is incredibly rare.

But why? Why is it so hard to feel peaceful when we think about money? After all, money is just a tool. It’s a means to an end, not the end itself. Yet, it has become one of the greatest sources of stress, anxiety, and sleepless nights for people everywhere.

Let’s explore why this happens and how we can change it.

The Money Paradox

Money, in its most basic form, is neutral. It’s neither good nor bad. But how we use it, how we think about it, and how we let it affect our lives is where things get complicated.

For most people, thinking about money is wrapped in feelings of fear, uncertainty, and pressure. Will I have enough? Am I saving too little? Am I spending too much? These are the questions that race through our minds when we think about our finances. And often, the answers aren’t clear.

On the flip side, there are those who avoid thinking about money altogether. This avoidance comes from a place of fear too, but it’s a different kind. It’s the fear of confronting financial realities, fear of making mistakes, and fear of admitting that we might not be in as good of shape as we thought.

In both cases, peace is elusive. Either we’re actively worrying about money, or we’re passively ignoring it, hoping things will magically work out. Neither of these approaches leads to peace. They lead to financial anxiety.

Why Is Peace Around Money So Rare?

1. Money Is Tied to Our Emotions

Money isn’t just about numbers. It’s about feelings. We associate money with security, freedom, power, and sometimes even love. This emotional connection complicates things. We don’t just look at our bank account and see numbers—we see what those numbers represent for our lives. Are we successful? Are we safe? Are we doing enough for our families?

When we tie our emotions so deeply to money, it’s no wonder that thinking about it stirs up so much anxiety. Money is no longer just a tool—it becomes a reflection of who we are and how we measure up.

2. Financial Illiteracy

Many people aren’t taught how to manage money effectively. Schools rarely provide comprehensive financial education, and most of us are left to figure things out as we go. As a result, people make mistakes. They spend too much, save too little, invest poorly, or avoid investing altogether.

The lack of knowledge makes thinking about money stressful because it feels like navigating a minefield. Without the tools and knowledge to make informed decisions, every financial choice feels risky.

3. Fear of the Unknown

Money is also tied to our future. When we think about money, we’re often thinking about things that haven’t happened yet—retirement, emergencies, or unexpected expenses. This focus on the future naturally brings uncertainty, and uncertainty breeds fear.

Peace requires a sense of certainty and security, but when it comes to money, so much is unknown. Stock markets fluctuate, jobs come and go, economies shift. There’s always an element of unpredictability, and that’s hard to reconcile with peace.

4. Social Pressure and Comparison

We live in a world where it’s easy to compare ourselves to others. Social media, advertisements, and the consumer-driven culture make us constantly aware of what others have. It’s easy to feel like we’re falling behind, even if we’re doing well financially.

This comparison game creates pressure. We feel like we need to spend more, earn more, and have more just to keep up. The pursuit of “more” is never-ending, and it prevents us from feeling satisfied with what we already have.

5. The Myth of Scarcity

Many of us operate from a mindset of scarcity. We believe there’s not enough—whether it’s money, time, or opportunities. This scarcity mindset makes us fearful of losing what we have and anxious about whether we’ll ever have enough.

Peace comes from a mindset of abundance, where we believe there’s enough to go around. But shifting from a scarcity mindset to an abundance mindset is easier said than done, especially when money feels tight or uncertain.

How Do We Find Peace?

The good news is that peace around money is possible. It just requires a shift in how we approach and think about our finances.

1. Adopt a Long-Term Perspective

When we think short-term, every financial decision feels urgent and high-stakes. But when we adopt a long-term perspective, we can relax a bit. We know that market dips are temporary, that our savings will grow over time, and that we don’t need to have everything figured out right now.

Thinking long-term helps us focus on steady progress rather than immediate results. It also reduces the pressure to time the market perfectly or make the “right” decision at every turn.

2. Practice Financial Mindfulness

Financial mindfulness means being intentional with your money. Instead of avoiding your finances or obsessing over every penny, take a balanced approach. Set aside time each month to review your budget, track your spending, and adjust your investments.

Being mindful doesn’t mean you need to micromanage every aspect of your finances. It just means that you’re paying attention and making informed decisions. When you’re intentional, you feel more in control—and that sense of control leads to peace.

3. Set Clear Goals

One of the best ways to bring peace into your financial life is to set clear, achievable goals. These goals give you something to work toward and help you measure progress.

Whether it’s saving for a home, planning for retirement, or building an emergency fund, having a goal in mind brings clarity. You know what you’re working toward, and every decision becomes easier when you have that goal as a guiding star.

4. Let Go of Comparison

It’s time to stop comparing your financial situation to others. Someone will always have more than you. They’ll have a bigger house, a nicer car, or a higher salary. But peace doesn’t come from having the most. It comes from feeling content with what you have.

Instead of focusing on what others have, focus on what’s important to you. What do you want your money to do for you? What brings you joy and fulfilment? Align your spending with your values, and you’ll find peace in your financial choices.

5. Embrace the Power of “Enough”

We often chase more money because we believe it will bring more happiness. But research shows that after a certain point, more money doesn’t equate to more happiness. Once your basic needs are met, peace comes not from accumulating more, but from appreciating what you have.

Ask yourself: What is “enough” for me? When will I feel secure, content, and at peace with my finances? Defining “enough” for yourself helps you stop the endless chase and focus on what truly matters.

6. Give Generously

One powerful way to find peace around money is through giving. When we give, we shift our focus from scarcity to abundance. Instead of worrying about what we don’t have, we recognize what we do have and share it with others. Giving, whether through charitable donations, helping a friend, or supporting a cause you believe in, cultivates a sense of fulfillment and connection. It reminds us that our wealth has a purpose beyond ourselves. Generosity fosters gratitude, reduces anxiety, and brings peace by creating positive impacts in the world around us. Giving is a way to find meaning in our financial journey, making every rupee feel more intentional and purposeful.

Financial Peace Is Possible

The intersection of “thinking about money” and “feeling peaceful” may be rare, but it’s not unattainable. It requires intentionality, mindfulness, and a willingness to redefine what success looks like for you.

Peace doesn’t come from having the most money. It comes from knowing that your money is working for you, aligned with your goals, and helping you live a life that matters.

So, the next time you think about your money, remember it’s not about having more. It’s about finding peace in the choices you make and the life you build.

That’s where true financial wellness begins.

and then tap on

and then tap on

0 Comments