You Never Needed to See it Coming

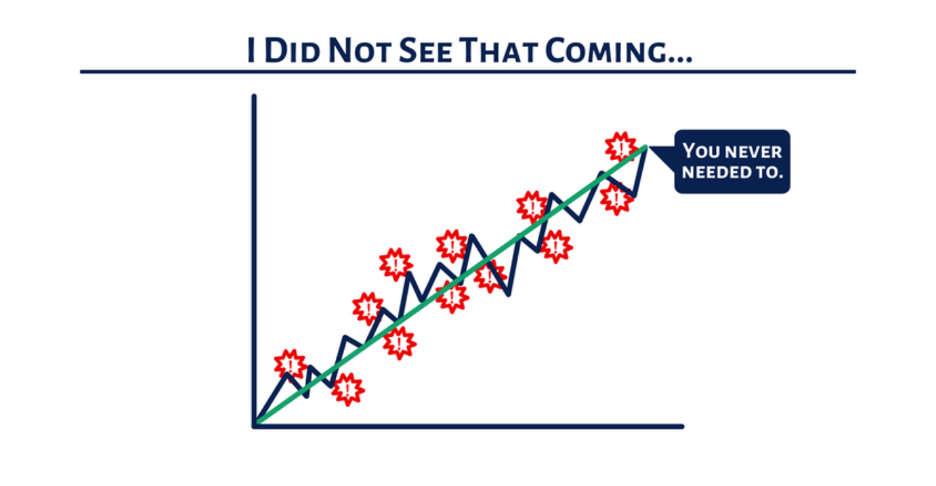

This sketch beautifully illustrates an important truth about investing: you don’t need to predict every market move to succeed.

Many investors feel they need to foresee every downturn, every crash, every piece of market turbulence. But in reality, you never needed to. The overall trajectory is what matters most.

Yes, there will be setbacks, drops, and unexpected shocks along the way. The red alert symbols in the image represent these moments of fear, uncertainty, and risk. But look at the green line. Over time, the market trends upward.

What does this mean for you as an investor?

It means that trying to predict every small dip or correction isn’t necessary. Doing so will in fact work against you. What’s important is staying invested and focusing on your long-term goals. Short-term volatility may feel unnerving, but it doesn’t change the broader upward trend of growth over time.

Just like we discussed ( in the previous Nano) , where unseen risks always exist, here we see that even when the unexpected happens, it doesn’t derail long-term growth. You don’t have to see every twist and turn coming. Instead, trust the process, trust the trend, and understand that growth often follows setbacks.

The key takeaway: you don’t need to predict the future. You need to stay disciplined, diversified, and committed to your long-term plan. Because when you zoom out, you’ll notice that these bumps on the road are part of the natural journey to financial growth.

Stay patient. Stay invested. Let compounding work for you. And you’ll get there.

and then tap on

and then tap on

0 Comments