The Real Cost of Noise

On 27th July 2022, Facebook aka Meta Platforms reported weaker than expected revenue and earnings for the second quarter. The stock tumbled 26% erasing some $251.3 billion of market capitalization…This was the biggest one-day wipeout in the market value ever of a US company. Just to set some context, the market capitalization of Bank of America is around $253 billion dollars… The Meta stock ended 2022 with losses of 65% and was the worst performer on the S&P 500 index that year.

Meta CEO Mark Zuckerberg reiterated his commitment to spending billions of dollars building the metaverse. Analysts were quick to downgrade the stock. Morgan Stanley downgraded the stock, and their analyst slashed his price to $105 from $205. Every other analyst came in with their downgrades. Besides excessive spending on the metaverse, analysts said that Meta is hurt by competition from TikTok, a broad slowdown in online advertising spending, regulatory woes and some challenges thrown by Apple’s iOS privacy update. In short, Meta was simply a SELL. And the projection of 2023 doesn’t seem to be any better.

Listening to this wisdom, many sold…Institutions sold…Individual Investors sold…

Fast Forward 27th July 2023, and Meta posted second quarter results that beat analyst expectations. The stock price was up by 9% and crossed the $300 mark. The Meta stock price had rallied by more than 150% in 2023. Analysts (as you might have guessed) are singing a different tune. Goldman Sachs raised its target to $384 from $300. Other analysts came out with similar upgrades.

Just think about this insanity for a moment, actually wait, does this even come across to you as insanity? I am sure it does…

The point here is no one knows anything about the future…No one…

What’s the cost of believing that someone does? The expense ratio of believing the Meta bullshit was 100-150%. But this cost is often invisible. We don’t see them when these predictions are made with such extreme confidence and fanfare. But they are real and extremely high.

The people who believe analysts/experts know stuff are clearly mistaken…Sure they know how to write, how to pitch to you but do they really know what’s going to happen…Nope…

Still don’t believe me…Here’s another example for you.

Pulak Prasad in his book “What I Learned About Investing from Darwin” shared an insightful example involving two companies. He wrote, “Let’s assess the 2 situations.

Case 1:

A company that has been profitable over many decades has recently fallen prey to smaller and more nimble competitors. It has suffered massive losses over the past two years. The company sells its highly engineered products to medium and large businesses. The board starts searching for a new CEO and identifies a promising candidate. There are however a few worrying problems with this choice: The candidate does not understand technology, he does not understand how to sell to businesses because he has run a business that sells biscuits to consumers(!), and he has no experience in turning around any business, let alone a complex engineering one like this.

Would you invest in this business once the CEO takes over?

Case 2:

A venerated hundred-year-old department store has been struggling over falling sales. Over the past four years, sales have fallen 10% from $20 billion to $18 billion, and the operating income has plummeted about 65% from $1.1 billion to $380 million. The stock price has crashed from $81 to $32.

The board appoints one of the world’s leading retail executives as the new CEO of the business. He has had 2 great successes in the past few years. As VP of merchandising at one of the largest U.S. retailers, he made the store appeal to young and trendy consumers. He also struck several designer partnerships that were a huge hit with shoppers. His next job was at a large company where he was responsible for opening retail stores. He hit the ball completely out of the park. The sales per square foot at these stores now exceeds even luxury retailers like LVMH. His innovations in design and service at these stores were so popular that shoppers now need to book an appointment many days in advance in many cities across the world.

Would you invest in this business once the CEO takes over?

I would not buy the shares of the first business but would load up on the second…I assume, dear reader, you would do the same. We would both be dead wrong. You and I would have missed out on a seven-fold increase in stock price over the next 10 years in the first business. We would have been wiped out completely- yes, with a 100% loss – in the second.

The first business is IBM, and its famous turnaround in the late 1990s was led by Lou Gerstner, the ex-CEO of RJR Nabisco.

The second business is JCPenney, where Ron Johnson, credited with transforming Target and creating the iconic Apple Stores, was brought in as CEO in late 2011. The stock price had jumped 24% on his appointment.”

The point I wish to make (once again) through these two examples is that “No one knows a thing about the future…No one…

If anyone couldn’t predict such clear-cut cases what hope do people have in situations that are not as clear cut?

Do me a favour.

Try to remember a time when you read or heard something about money in the news, you acted on it, and then, with the benefit of hindsight, you were glad you did.

This could include any number of things: the latest IPO, bear markets, bull markets, mergers, market collapses.

Go ahead, I’ll wait. Close your eyes and think about it.

I’ve done this experiment hundreds of times around the world, and I’ve only had one person come up with a valid example. It was news about a change in the tax law.

That’s it.

Isn’t that interesting?

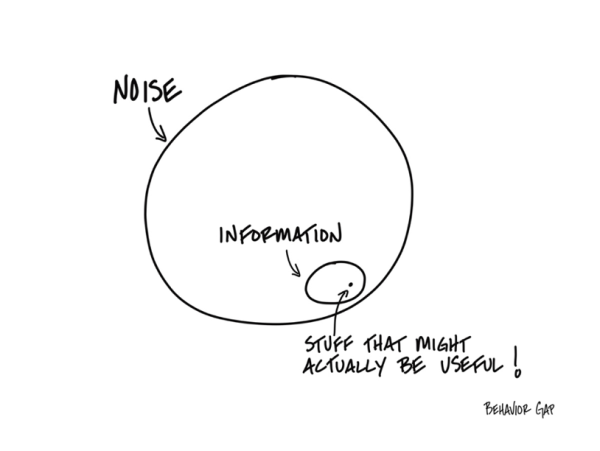

Think of all the financial pornography out there, think of all the offices that have CNBC playing in the background, think of all the newspapers and magazines that talk about money. Almost all of it is noise.

Sure, every once in a while, there is this little, teeny tiny speck of information that might be useful. But you sure have to wade through a lot of garbage to get to it.

This leads to one obvious question: Why are we paying attention to this noise (garbage) in the first place?

It might be fun, if you’re into that kind of thing. You know, like going to the circus.

But most likely, it’s just a waste of time.

And more importantly it’s expensive…

It not only costs you money, but it also costs you your time, energy and attention.

What if, instead of obsessing over the financial pornography network and this noise, you used that time to work on that list you have…

You know, “The List.” The one that has all the really important things you actually want to do with your time.

Doesn’t that sound so much better than spending another hour watching CNBC or reading the financial news?

and then tap on

and then tap on

0 Comments