Which Quadrant do you want to be in?

Which Quadrant do you want to be in?

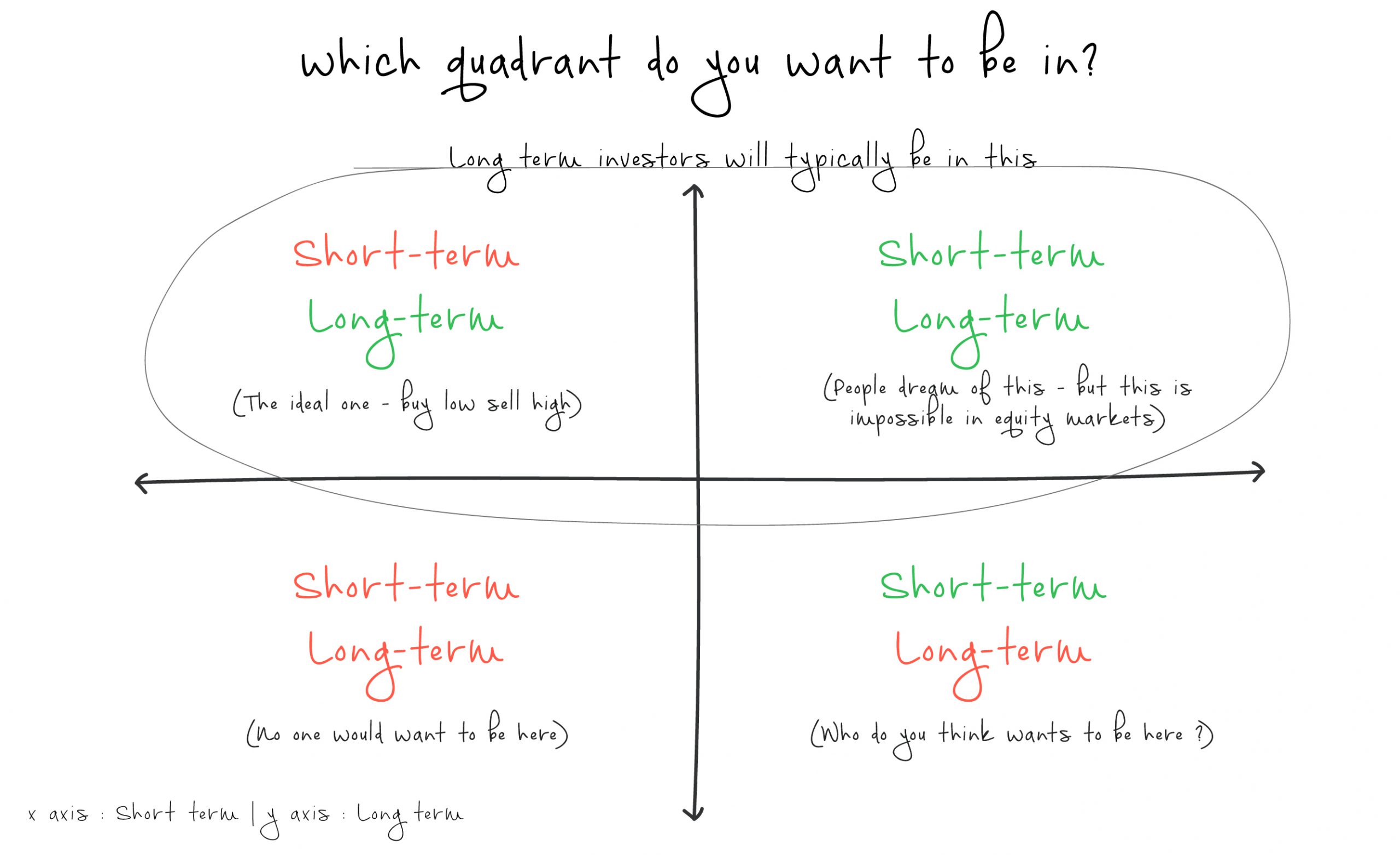

Look at the Visual above with the 4 quadrants. The Visual is self-explanatory but nevertheless, let me ask you one more time “Which Quadrant do you want to be in?”

Quadrant 1 – Short-Term Green and Long-Term Green

Everyone wants to be in this Quadrant. Most of the investing errors are committed thanks to our strong desire to always be in this quadrant. Truth be told – it is simply not possible in the stock market. While there are times (it’s as high as 70-75%) when you will be Short Term Green, any Long-Term Green investor will at least spend 25-30 % (if not more) of the time in the Short-Term Red Quadrant. This is the reality of how stock markets operate.

So, while we would always want to be in this quadrant, trying to do so would be injurious to our wealth.

Quadrant 2– Short-Term Green and Long-Term Red

Who do you think wants to be here?

Short-Term Green – Everyone wants this

Long-Term Red – No One wants this

Market Timers in their thirst for Short Term Green (100% of their time) end up in this quadrant. For example, last year some timers I know (they think they are savvy) exited the stock market at 34000 on the Sensex locking their gains. They stayed out of the market till 51000 now, missed a 50% rally and just entered last week again.

There are countless such examples of errors committed while trying to time entry and exit. Market Timers end up either in this quadrant or the next one Quadrant 3

Quadrant 3 – Short-Term Red and Long-Term Red

No one wants to be here and why should anyone.

Sadly, again a favourite picnic spot (along with Quadrant 2) of Market Timers

Quadrant 4 – Short-Term Red and Long-Term Green

Ideal Spot for everyone and my favourite spot too. This is because I am in the accumulation phase and anyone who has a long-term horizon will be better off being in this zone. We get to buy low when we are in the Short-Term Red Zone. The risk goes down, and the expected returns are generally higher when the markets are down.

Investing at a Sensex Level of 42000 in January 2020 would have given you a 20% return but an investment made at 30000 in March 2020 would have delivered a 60-70% return in the last 15-16 months provided you were comfortable enough to invest when the markets went down. Even if there is no surplus liquidity to invest, the sheer act of just staying put could result in double digit tax advantaged returns.

This Quadrant generally lasts for a few to several months but there are times when you can even witness this for a few years (though it is not the norm). This happens frequently within sectors, and you would have seen Pharma down before COVID-19 for an extended period of 4+ years. Those who understood the short-term red phenomenon were comfortable investing in pharma when it was not performing. Most people want to exit on seeing short term red and more so when there are noises around us telling us it is best to do so.

The powerful insight to understand here is the following:

Investing in Short-Term Red and Staying Invested in Short-Term Red = Wiser and Only Real Path to Long Term Green

You cannot avoid Short Term Red. The Best Investors have gone through this, taken advantage of it (if they had money) or just stayed put.

There are simply no shortcuts. Period.

and then tap on

and then tap on

0 Comments