The Right Answer

Why is your money invested the way it is was the question I asked Ashish (a savvy investor in his late forties).

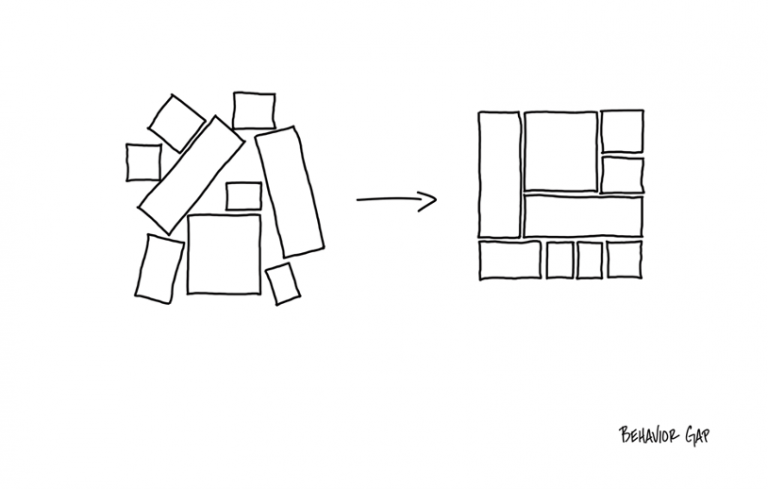

Like many, Ashish had a hodgepodge of products. And the more sophisticated you think you are, the more disjointed and complex your portfolio is. Ashish thought of himself as a sophisticated investor.

He thought for a moment and replied, “There is no one answer. It’s been a combination of many things over the years.”

He added further, “My friend told me to buy certain products. Then my bank relationship manager sold a few. My newly appointed wealth manager at this IYSL got me to buy these structured products, portfolio management schemes, and alternative investments. My friend was a part of a network, and he got me in on some private investments.”

These are some of the common responses I have heard from many over the last 2 decades. The other common ones are:

I heard an expert on the financial channel. More than channels, there are other popular avenues these days – I heard a finfluencer on social media. There are people all over YouTube, Twitter, Facebook, Instagram, and even Tiktok (did I miss mentioning any).

I read about it in the newspaper.

I saw an advertisement for the product.

My patient sold me this.

I did it for tax purposes.

I invested for higher returns and loads of safety.

Everyone in my office was doing this so I did this.

What’s your answer to this question – Why is your money invested the way it is?

Another variation of this question is Why is your portfolio built the way it is.

These questions are foundational when it comes to your money and your life. Thus, it is so important that you reflect on this one if you haven’t so far. It’s super important to nail them. Take a few minutes and write down your answers. If you can’t do this exercise by yourself, it’s best to reach out to your friendly neighbourhood Spiderman. Oops, I just went with the flow. What I really meant was to reach out to your Real Financial Professional.

There are people shouting from the rooftops today – I just made a million or I just tripled my money. Some people are indicating 819% returns on their website. To protect themselves, they smartly package this as model portfolio returns. If you happened to be reading this advertisement, you might at least be tempted to take a look at what they are saying. Perhaps they know something you don’t or maybe they know something that your Real Financial Professional does not. Looks like there is a secret. And you get sucked into this hole.

Come to think of it, how hard is it to live your own life? How hard is it to figure out what really matters? How hard is it to figure out what’s important to us? How hard is it to stop comparing ourselves to others?

It is not so easy to avoid this noise. It is not easy to avoid this make quick money trap. There is this strong mimetic desire that keeps pulling us to this one magical investment. You justify this by saying things like “My friend is so smart, and he has been doing this for donkey’s years. Everyone in the club keeps talking about this. Let me do this one time or else I will regret it later.” And this applies not only to exotic investments but also to bank deposits, bonds, gold, real estate, mutual funds, and stocks.

Let me tell you a secret.

The secret is that there is no secret.

The Right Answer is …

My money is intentionally invested to help me achieve all my needs and my cherished goals.

My portfolio is intentionally built to help me live the life I have imagined with my money.

My portfolio is intentionally constructed based on my purpose and values.

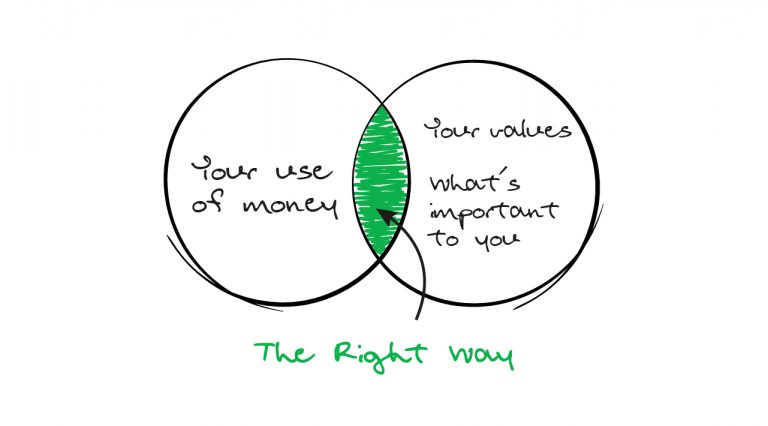

Who you are is defined by your values!

And the way your money is invested, or your portfolio is constructed is a function of who you are and your values.

In case you are still confused about values, let me seek Mark Manson’s wisdom from his book “The Subtle Art of Not Giving a F*ck Journal”.

“Every moment of every day, whether you realize it or not, you are deciding how to spend your time, what to pay attention to, where to direct your energy.

Right now, you are choosing to read this post. There are an infinite number of things you could be doing instead, but right now you are choosing to be here with this post. May be in a second, someone will text you and you will focus on something else. Maybe you will decide to watch a movie.

When those things happen, you are making a simple, value-based decision: your phone is more valuable to you than reading the post at that moment. Your behaviour then reflects what you truly value. Our values are constantly reflected in the way we choose to behave. The things we choose to prioritize. This is critically important – because we all have a few things that we think and say we value, but we never back them up with our actions. In fact, we are often operating at a level of disconnect between what we say we value and what we actually spend our time doing.”

And the one place where it reflects the most is in what we decide to do with our money or how we construct our portfolio.

We say security is important to us. But we are always under insured. We don’t bother to buy the insurance that is truly required. We say trust is important to us but then we listen to all the bullshit stories that are sold to us. We say we value integrity and people acting in our best interests, but we simply continue to entertain and even give business to people who take us for a ride. And we penalize those who take care of us and for doing their job honestly (Don’t think so but this is an interesting post for some other Tuesday)

There is no other right way to invest other than the one that helps you live your values. To be true to the one life that we have all been blessed with.

and then tap on

and then tap on

0 Comments