The Patterns that don’t work

Recently, I had a conversation with a senior executive from an asset management firm. He was explaining all the reasons why his firm’s funds had not performed for the last 2-3 years. He then talked about some research they had done and the interesting frameworks they had come up with. “All of this is back tested with data and goes to prove that our models will work”, he said.

Back Testing is an interesting phrase in the investment world as it’s often used to sell new products and to prove that one can indeed find patterns (and more importantly that patterns work). I am fascinated with this back testing (and looking for patterns) topic, so my antennas always go up when someone starts talking about back testing and how they have discovered something really new.

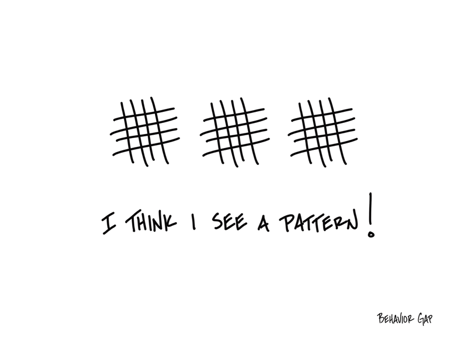

We’re so good at recognizing patterns that we often see them where they don’t even exist. Many investors waste a lot of time and money looking out for patterns in a random and uncertain world. Thus, it’s quite natural for the financial services industry to keep coming out with new patterns all the time (supported by back testing) to sell new products.

The author of Behavior Gap, Carl Richards, shared something super funny but powerful.

He wrote – One of my favorite examples of this is some research done by David J. Leinweber at Caltech. Apparently, he figured out how to predict the stock market using just three variables:

1. Butter production in the United States and Bangladesh.

2. Sheep populations in the United States and Bangladesh.

3. Cheese production in the United States.

Amazing! Right?

It turns out these three variables predicted 99% of the stock market’s movement!

Wow, 99% of the stock market’s movement. All that is required are these 3 variables.

Except that – The Joke’s on us.

While well-intentioned, the constant pursuit of patterns is one of the big behavioral mistakes we make time and again. We look for patterns. And guess what, they exist right up until you try to invest your money based on the pattern. Then *Poof!* They vanish into thin air.

Now imagine something as mundane as driving.

Can you truly drive a car safely while looking in the rear-view mirror?

Investing based on back testing and patterns is similar to driving by looking into a rear-view mirror.

Let me ask you another question.

Will your drive today exactly follow the path you followed yesterday?

Nope. You might have stopped at more signals. You might have encountered more traffic. A rash biker would have crossed the red light and come right in front of you. Just because you experienced it yesterday does not mean you will experience it today. It’s not the same day or the set of people on the road or the same environment. I believe you are getting the point that I am trying to make here.

Greek Philosopher Heraclitus had written something wonderful (pardon the gender reference) “No man ever steps in the same river twice, for it’s not the same river and he’s not the same man.”

This applies to the world of investing. The buyers and sellers are different every day. There are even different types of buyers and sellers each day each playing their different game. The News Flow is different. There are thousands of variables that have no correlation to each other that are at work. In short, everything is different. So, simply because it worked in back testing does not mean it will work in the future. For all practical reasons, it will simply not work.

And that’s the thing about most patterns—they don’t predict the future; they simply describe the past.

While some of these silly data mining tricks might be interesting to talk about, they don’t actually help us. They simply help firms market well and gather assets just like ESG (well this is a topic for another day).

The 2 things that do help when it comes to investing success is great behaviour and letting compounding work for you. Day in, day out, year after year.

Now that’s a pattern I can endorse.

and then tap on

and then tap on

0 Comments