The New High

“Is the market too high to invest?”, Rahul (a friend) asked. Anil (a neighbour) who overheard this question joined in the conversation, “The Sensex is 70000+. It’s made a new high. Isn’t the market too high?” Even if you haven’t asked this question, chances are that this thought might have come across your mind. If it hasn’t, a big pat on your back. On hearing these questions, the questionologist in me woke up with some counter questions, “Why do you say that guys? Didn’t you both ask me the same question at 45,000 and then at 50,000?”

Rahul responded, “Yes, we did, and truth be told, I personally waited a long time for a major correction at 45,000. Even when some corrections happened, I did not invest. I guess fear was holding me back. I kept seeing new highs being made and every new high made me even more fearful.”

I added, “I completely understand where you are coming from. It’s just human to feel this. Every high the stock market makes will feel like the ultimate high but sooner or later there will be yet another new high. This is one of the ultimate truths of the stock market. The stock market will make a new high at some point of time. And new highs will continue to be made over the months, years, and decades.”

Do you by any chance remember how you felt when the Sensex hit 7,000 in 2005? You might not remember it today, but I bet you felt like it was the ultimate high. You felt the same at 10000 (because I remember our conversation). Ditto at 11,000 (a 10% jump), then at 12000, 20000, 30000, 40000, 45000, 55000, 60000 and now at 70,000. Despite all these feelings and worries, the stock market kept making new highs. While we might be worried today about the 70,000 levels, the truth is we will all forget about it once the Sensex hits 100,000, and then 200, 000 and then 700,000. Because at that point of time we will be fixated on the New Highs of the Season. And Sensex will hit these numbers over the next several years and decades; it’s just that no one knows when.

But the key question here is are you investing for the next 5000 points which is 6-7% from the current levels or are you investing for the Sensex at 200,000 or 700,000.

What are you investing for?

If you are investing for the next 6-7% then don’t, because it means you have a very short-term horizon. Anything can happen in the short run. Investing in the stock market should be done from a long-term perspective (decades not days or months or even a year or two). However, if you are investing for the Sensex at 700,000 (which I know you are), then there is nothing to worry even if the Sensex goes down in the short run. Because if you stay invested all the way to 700,000 levels you get to capture the marvellous asymmetric upside of the stock market. A point to note here is that there is nothing that the stock market has not overcome (global financial crisis, global pandemic, oil and inflation shocks, debt crises, wars)

The important thing is the ride to 700,000. It’s not whether you predicted the fall correctly. As you have experienced it’s useless to correctly predict that the stock market will go down and then not invest when it goes down. It’s far smarter to invest, stay invested (through corrections and crashes) and keep investing as you have surplus money.

The problem with many is that they are unclear about the purpose of this guessing game.

Is it to prove that you are smart and short-term right or is it to make money by being long-term right?

Rahul and Anil were in deep thought and said, “We know what you are saying Amar, but it’s scary.”

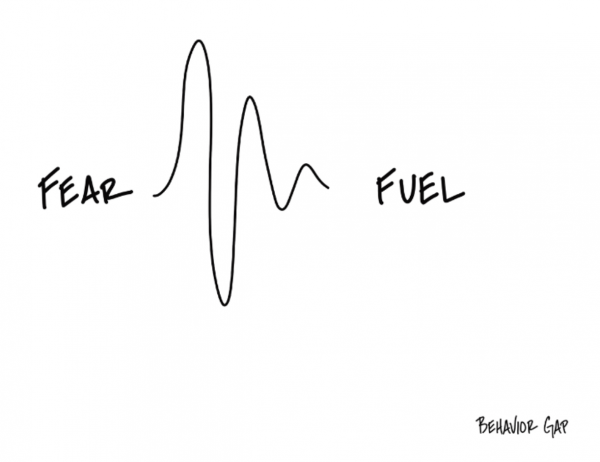

I then shared an interesting sketch of Carl Richards along with his nice little story.

“I’m not a Buddhist, but I do like many Buddhist teachings. One of my favourites is about a great battle the Buddha had with the demon-God Mara just before reaching enlightenment. I’ve heard psychologist and meditation teacher Tara Brach talk about it like this:

One day, Buddha was teaching a large group, and Mara was moving around the edges, looking for a way in. One of Buddha’s attendants saw Mara, ran to Buddha, and warned him of Mara’s presence. Hearing his attendant’s frantic warning, the Buddha simply replied, “Oh good, invite Mara in for tea.”

I love this story because it beautifully captures how we should respond to scary things. “Don’t run away from them, invite them in.”

If there’s one thing I’ve learned in life, it’s that scary doesn’t mean bad. Quite the opposite. I’ve learned to associate fear with good things to come- growth, excitement, self-improvement. Fear, it turns out, comes before all the most awesome things I’ve ever done.

Considering that, shouldn’t fear be something we want more of in our lives?

It’s time to stop thinking of fear as a stop sign. It’s time to see it as fuel.

As Shantideva put it:

“If you can solve your problem, then what is the need of worrying? If you can’t solve it, then what is the use of worrying?”

Worrying endlessly about something that may or may not happen in the future doesn’t help. But planning for what to do if that thing comes to pass does.

You don’t have to do this alone. In fact, you shouldn’t do this alone. The guidance and wisdom of a caring real financial professional is invaluable.

That’s it. You will probably not need to worry about that scenario anymore because you now have a caring professional in your life to come between you and your worries.

Next time you find yourself in one of those cycles of worry, remember what Shantideva said. Action is a strategy, worry is not. So, have a caring real financial professional, plan, invest, stay invested, keep investing, and get back to work.

As Robert Arnott said, “In investing, what is comfortable is rarely profitable.”

and then tap on

and then tap on

0 Comments