The 20 Best Days in the Last 20 Years

Look at the above table closely.

What do you see?

The best 20 days in the last 20 years have come when the markets have been at their worst or in a deep corrective phase.

- 11 out of these 20 days are in 2008-2009(in the worst 16 months)

- 3 are from March and April 2020

- 2 are after the Technology Bubble Burst

- 1 is After BJP lost in 2004 when the markets had tanked for a couple of days

- 2 are after a sharp correction in 2006

Only 1 out of 20 happened when the markets seemed in an Up Move. 19 / 20 of the Best Days have happened during seemingly worst times (Did you really know this?)

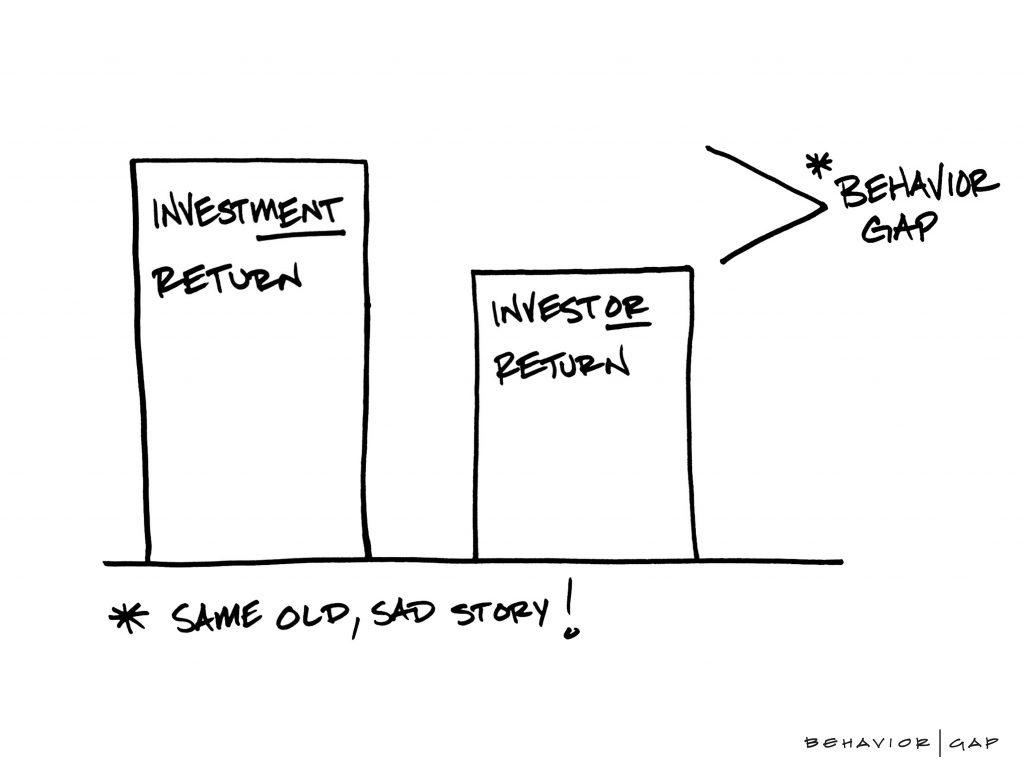

Think about this. Most people are out of the market in corrective phases (or sharp falls). The media screams for you to be fearful in such phases yet the best Up moves are in such phases. This is one of the keys reasons why there is a difference between Investment Return and Investor Return. Carl Richards calls this the Behaviour Gap and it is depicted brilliantly in this sketch of his.

What are the learnings for you here?

Down and Up moves in the market (Volatility) are a natural part of the investing process. The only way to capture these best days are by staying invested through down move days. There is NO OTHER WAY. You simply cannot get IN and OUT of the market because both the moves (down and up) happen in close proximity to each other. Any person who is telling you that he can get you IN and OUT is LYING. Yes, someone might be lucky once or twice in getting out, but have they got back in time. Absolutely Not.

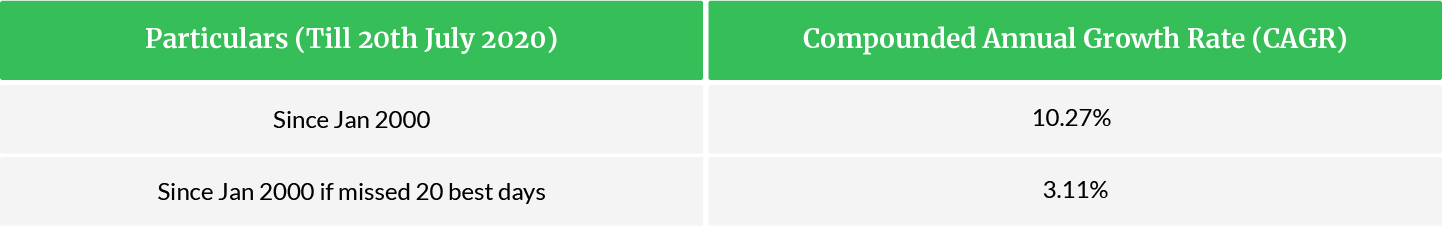

Let us see what happens if you missed these Best 20 days in the last 20 years.

There were 5112 trading days in the last 20 years. If you missed 20 days only out of 5112, your returns are lower by 7.16% p.a.

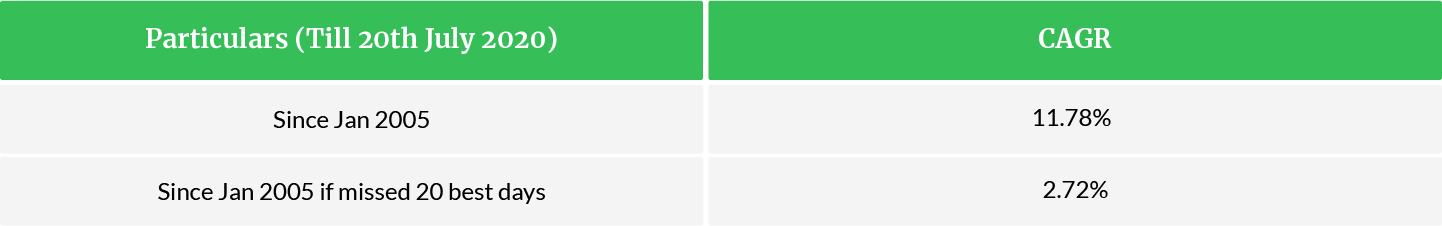

Can you imagine this. Missing 20/5112 = 0.39% best days has a tremendous impact on your overall financial well-being. Do this exercise since 2005 till date and you will see the following table.

This only goes to show that even if you are invested 99% of the time but miss the (less than 1%) best days, your performance will significantly lag investment performance.

Thus, I repeat “The only way to capture the best 20 days is by having loads of patience and staying invested through the tough times”.

and then tap on

and then tap on

0 Comments