Reframing the Spending Narrative

I got a lot of love for last Tuesday’s post “Special Reveal: The Journey into The Philosophy of Money.” Many of you even wanted to pre-order the book. We will get to that at some point of time soon, but let’s first check out a few interesting thoughts that I received (from the post) on the topic of spending.

One reader wrote, “Thank you for writing this one Amar. As I read the post, my thoughts go to my own spending. I always feel guilty after spending. When I am doing it, it feels good but then I always feel guilty about the spend.” Another lady wrote, “I want to spend but I can’t get myself to spend. I have always been told to not spend.”

“Why is it that the first, primary relationship we have with money is always a negative one: Don’t spend it! Control it! Cut, cut, cut!

Our mindset towards money is often rooted in fear and scarcity, where the focus is solely on saving and minimizing expenses. This approach, while prudent in some respects, can also lead to a restrictive and joyless relationship with money.

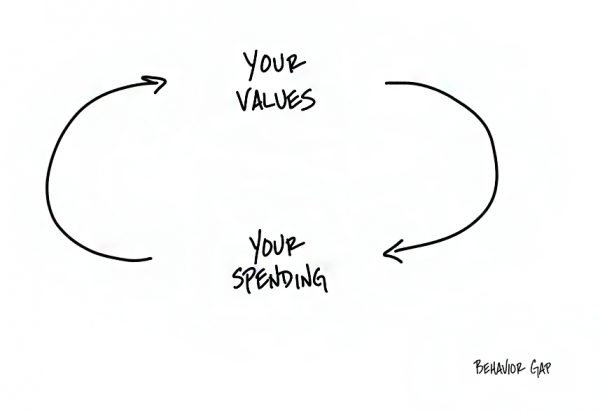

What if we changed that? What if our entire framework around spending became a practice, just like a meditation practice, in which we aligned our spending with what’s important to us? The idea is not to spend recklessly but to spend intentionally, with a clear understanding of what brings us joy and fulfilment.

The Practice of Mindful Spending

How do you do it?

The concept is simple: You spend, you notice.

Just like mindfulness meditation, where you bring awareness to your breath or thoughts, mindful spending requires you to bring awareness to your financial transactions.

Each time you make a purchase, you pause and reflect on the experience.

Did it bring you joy? Did it serve a purpose? Was it in alignment with your values?

Discovering Your Values Through Spending

Want to know where your values lie?

Look at how you spend your money. If you don’t like what you see, yeah, it might hurt a little, but it gives you valuable information that allows you to change your behaviour. For example, if you find that a significant portion of your income goes towards dining out, yet you don’t derive much satisfaction from it, this realization can prompt you to redirect those funds towards something more meaningful to you, such as travel, hobbies, or saving for a future goal.

The Goal: Value-Driven Spending

The goal here isn’t to spend less. It’s to spend lavishly on the things you value and cut ruthlessly on the things you don’t. This shift in perspective allows for a more fulfilling financial life, where your spending aligns with your personal values and priorities.

Practical Steps to Mindful Spending

- Track Your Spending: Personally, I hate this step, but nevertheless it’s useful. Start by tracking every rupee you spend just for a week. Use a simple notebook. This will help you see patterns and identify areas where you might be spending more than you realize.

- Reflect on Your Purchases: At the end of the week, review your spending. Ask yourself whether each purchase brought you joy or served a necessary purpose. Was it aligned with your values?

- Identify Core Values: Take time to define what’s truly important to you. Is it family, travel, education, health, or perhaps personal development? Your spending should reflect these values.

- Create a Value-Based Budget: Based on your reflections and identified values, create a budget that allocates more funds towards the things you value most and less towards the things you don’t.

- Practice Gratitude: Cultivate a sense of gratitude for the things your money allows you to experience. This can help shift your mindset from one of scarcity to one of abundance.

Examples of Value-Based Spending

- Investing in Experiences Over Things: Research has shown that spending money on experiences, such as travel or attending events, tends to bring more lasting happiness than spending on material goods. I bet your own experience will demonstrate this to you. Often, the memorable experiences you share with others and the stories you accumulate from these experiences hold more value and joy than the latest gadget or piece of furniture. That doesn’t mean don’t buy the gadget. Do it if that’s what you value.

- Prioritizing Health and Wellness: Allocating funds towards activities and products that promote your physical and mental health can provide substantial long-term benefits. Investing in a strength coach is an example of value-based spending for many, so is spending on a comfortable mattress that supports your back. If a Starbucks cappuccino gives you that joy, go for it (don’t feel guilty – you have the permission).

- Supporting Personal Growth: Investing in education, courses, books, and hobbies that align with your interests and goals can lead to a more fulfilling life. Continuous learning and personal development help you stay adaptable in a rapidly changing world, increase your self-confidence, and open new opportunities for career and personal achievements.

The Ripple Effect of Mindful Spending

When you start to spend intentionally, you may notice a ripple effect throughout other areas of your life. By focusing on what truly matters, you can reduce clutter, decrease stress, and increase overall life satisfaction. You may also find that your financial goals become clearer and more achievable because your spending is now aligned with your long-term aspirations.

Overcoming Challenges

Mindful spending is not without its challenges. It requires ongoing reflection and adjustment. You may encounter resistance, either from within yourself or from others who don’t understand your new approach. However, by staying committed to your values and being patient with the process, you can gradually transform your relationship with money.

Spend, Notice, Repeat

The journey towards mindful spending is continuous. Spend, notice, repeat. Each cycle of spending and reflection brings you closer to understanding what truly matters to you and how your financial decisions can support a more meaningful and joyful life. By embracing this practice, you not only enhance your financial well-being but also develop a deeper sense of satisfaction and purpose in your everyday life.

and then tap on

and then tap on

0 Comments