Plug These First

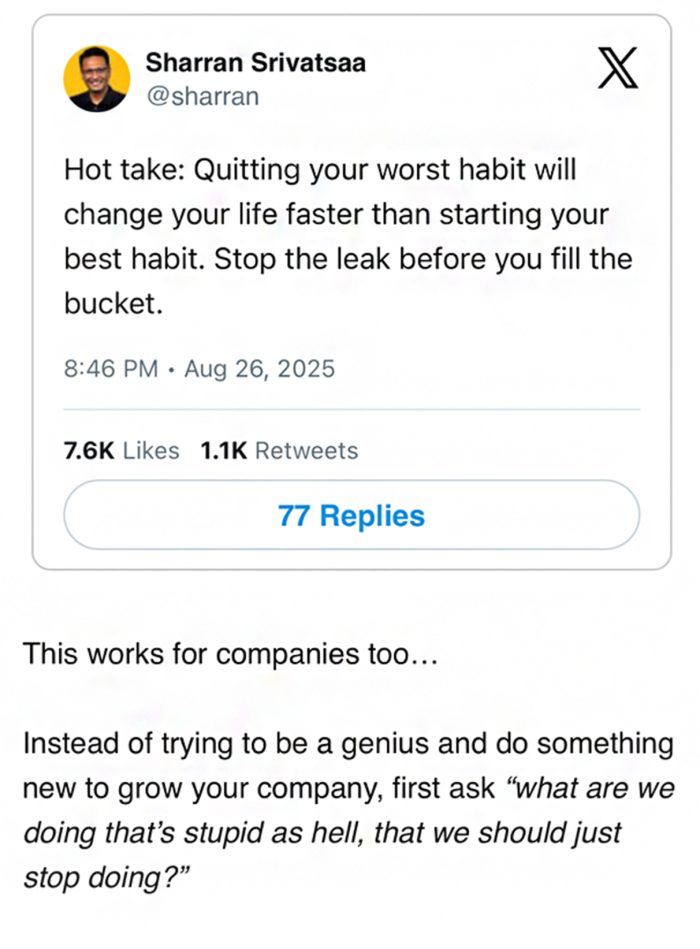

The same is true for your investments. Many investors are obsessed with finding the next great product or chasing higher returns. They believe that adding more will solve their problems. But often the faster way to build wealth is not by adding, it is by subtracting. By plugging the leaks that quietly drain your bucket.

Think about taxes. Poor tax planning can eat away a significant part of your returns. Profit sharing or giving away too much in the wrong structures reduces what stays with you. Constantly timing the markets creates unnecessary costs and mistakes. These are obvious leaks.

But there are other leaks too. Keeping excessive money in products marketed as safe investments while eroding purchasing power. Chasing hot tips and speculative bets. Selling too soon because of fear. Booking profits too early instead of letting compounding work. Over diversifying without thought. Or the opposite, being concentrated out of greed. Each of these behaviors quietly pokes holes in your financial bucket.

The irony is that most investors focus on what new they can do. A new fund. A new asset class. A new strategy. But rarely do they pause to ask, “What am I doing that is actually hurting me, that I should just stop doing?”

Wealth is often protected more by what you avoid than by what you add. Plugging leaks may not look exciting. It may not give you stories to brag about. But it builds real wealth, quietly and powerfully.

The smartest investors are not the ones chasing the next shiny object. They are the ones quietly closing the holes that others ignore.

Ask yourself where your bucket is leaking. Fix that first. Because only when you stop the leaks does filling the bucket truly matter.

and then tap on

and then tap on

0 Comments