From Exit Polls to Election Results

All the exit polls (of the Indian Parliamentary Elections) on June 2nd, 2024 showed a thumping victory for BJP and NDA. An industry executive sent me this video – Bulls Watching Exit Polls…

Kindly watch this one.

June 3rd, 2024 – The Sensex reacted in a similar way and jumped up by 2507.47 points making an all-time high of 76468. The Midcap and other indices celebrated too with up moves of 3-4%.

June 4th, 2024 – Real election results were not slightly different but dramatically different. I believe you have already read enough about this. There was a bloodbath with the indices correcting from 5-7%…Individual stocks were hammered with many heavyweights losing as much as 12-25%. When was the last time you saw this?

The Sensex ended at 72079 (down by 4389 – close to 6%). This sharp selloff resulted in wiping out Rs.31+ Lakh Crore ($360 billion) in market capitalization.

Some observers said that after this steep correction the Nifty’s (another stock market index) one year multiple had fallen below its five-year average. Others said India continued to command a premium valuation over other emerging markets.

A point before I move forward – These events showed once again that no one knows a thing about the future. Even the expert forecasters or gurus. The future is unknown. And the future will remain unknown. We can either keep listening to these predictions or we can plan. We can either react or we can thoughtfully act.

June 5th, 2024 – Many expected a continued sell-off in the next few days, but the stock markets once again surprised most people…As I had written in my previous post – “These results (whatever they are) will be forgotten soon… This is because the stock market is a forward-looking discounting mechanism. In plain English, this means the stock market anticipates future events and reflects expectations about future corporate earnings, economic conditions, technological advancements, and global geopolitical events in the price of stocks.”

The Sensex went up by 2303 points to end the day at 74382.

What really happened here?

There was a realization that a coalition government (with the BJP dependent on its allies) was not such a bad thing.

Let’s rewind back a bit. The 2009 general election was held against the backdrop of the global financial crisis. The incumbent UPA government, led by Manmohan Singh, won a decisive mandate, which was perceived as a vote for continuity and stability.

Market Reaction:

- Before the Election: The stock market was volatile, influenced by global economic conditions and the uncertainty of the election outcome.

- Immediate Aftermath: The clear victory of the UPA led to a massive rally in the Indian stock market. On the first trading day after the results, the Sensex surged by over 17%, leading to a rare instance where trading was halted due to upper circuit limits being hit.

Do you remember the Sensex surged by over 17% in a single day?

I bet no one remembers this now…

- Long-Term Performance: The positive sentiment continued, with the Sensex experiencing significant gains in the following months. Despite some mid-term volatility, the market showed a strong upward trend over the next few years. By the end of 2013, the Sensex had doubled from its post-election levels in 2009.

More importantly, the 2024 election outcome was never seen as a risk to India’s macro position as a fast-growing economy with moderating inflation, positive credit ratings, rising foreign exchange reserves, and a robust financial system.

June 6th and June 7th, 2024

The next two days yet again saw the Sensex (and other indices) jumping up. The Sensex ended 7th June (the week) at 76,693 with Foreign Institutional Investors turning up as Net Buyers (after being sellers for a long time).

Market Volatility is Absolutely Normal and in fact a fundamental requirement of the stock market.

By that I mean it’s volatility that makes the stock market a stock market. It is an inherent part of investing in the stock market. Prices fluctuate daily based on various factors, including economic data, corporate earnings, geopolitical events, and investor sentiment. It’s essential to understand that these fluctuations are normal and to avoid making impulsive decisions based on short-term market movements.

While short-term market movements may be influenced by news events of the day, investor sentiment, and other factors, long-term performance is rooted in real economic fundamental drivers.

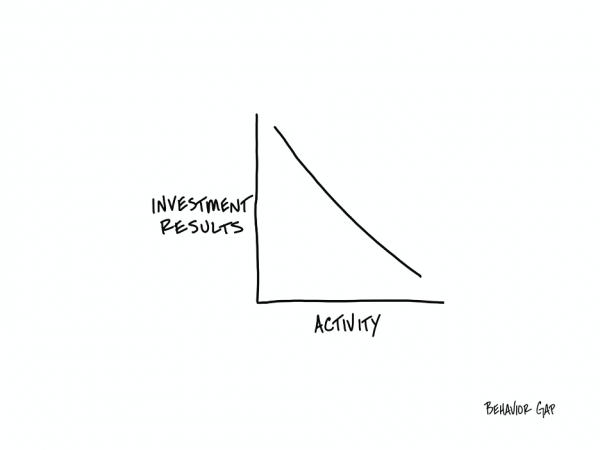

The short term and long-term graphs of investing indeed look like the above sketch.

The best part is that you have a choice.

You get to decide what you focus on.

Hold on… let me repeat that in case you missed it.

You. Get. To. Decide. What. You. Focus. On.

When it comes to investing, that means you have a choice. You can focus on days or decades. You can focus on the news of the days or focus on decades (and compounding).

But Your Emotion is the Enemy of Real Investing.

Emotional decision-making is one of the biggest obstacles to successful investing. Fear and greed can lead you to take impulsive actions, such as panic-selling during market downturns or chasing after hot stocks/investments without a thorough diagnosis of how these fit in your financial life. These actions often result in suboptimal investment outcomes and very costly mistakes.

To address the impact of emotions, it’s essential to have a well-thought-out investment strategy (and plan) and stick to it. Establishing clear investment goals, risk tolerance, and a diversified portfolio can help you stay disciplined during such market fluctuations and intense volatility. Regularly reviewing and adjusting your plan, while avoiding knee-jerk reactions to market events, will contribute to long-term success. And to do this, you need the care and guidance of a world class real financial professional.

Remember Investing is a Marathon, not a Sprint.

Successful investing requires patience, discipline, and a long-term perspective. It’s not about making quick gains but about building wealth gradually over time. By focusing on your long-term goals and staying committed to your investment strategy, you can navigate the ups and downs of the market and achieve all the financial success you deserve.

The Sensex has gone up all the way from 100 to 76,000 from 1979 till date…This is a rise of 760 times over 45 years…Isn’t this incredible?

While the stock market usually goes up, it goes down sometimes too…But as you know, these declines are temporary. Investing is a journey, and there will be periods of both growth and decline. Staying the course, even during the most challenging times, is essential for realizing the full potential of your investments.

Investing is a place where you get rewarded for being lazy. That may seem counterintuitive, because we have been trained to think that when we do more, we get more…

That activity = results.

But as we know investing is a do-less proposition because of the power of compounding.

The Sensex will keep making new highs…If you don’t believe this or need some reassurance, read this post “The New Highs: Milestones or Warning Signs?”

The Sensex will hit 100,000 and then 200,000 and 300,000 and then 1,000,000. It’s just that we don’t know when these milestones will be hit. If you knew the exact date, I bet you would stay invested. So how does it matter if the Sensex takes a detour once a while before it hits these milestones? The only real way to capture the full value of these milestones (and beyond) is by staying invested.

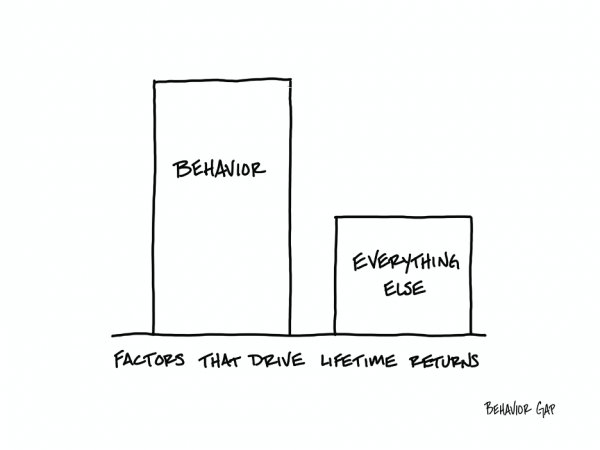

Finally, the single most important factor in a lifetime of successful investing is your own behavior.

You could have the greatest portfolio ever created. But one poor behavioral mistake a decade, and you might as well have just kept your money in the bank.

In fact, I would argue that portfolio design only matters to the degree that it influences your behavior.

So next time some hand-wavey person on the financial pornography network starts talking about how you should buy, sell, or do anything at all, just remind yourself: none of that matters if you don’t behave.

So how are you behaving now?

and then tap on

and then tap on

0 Comments