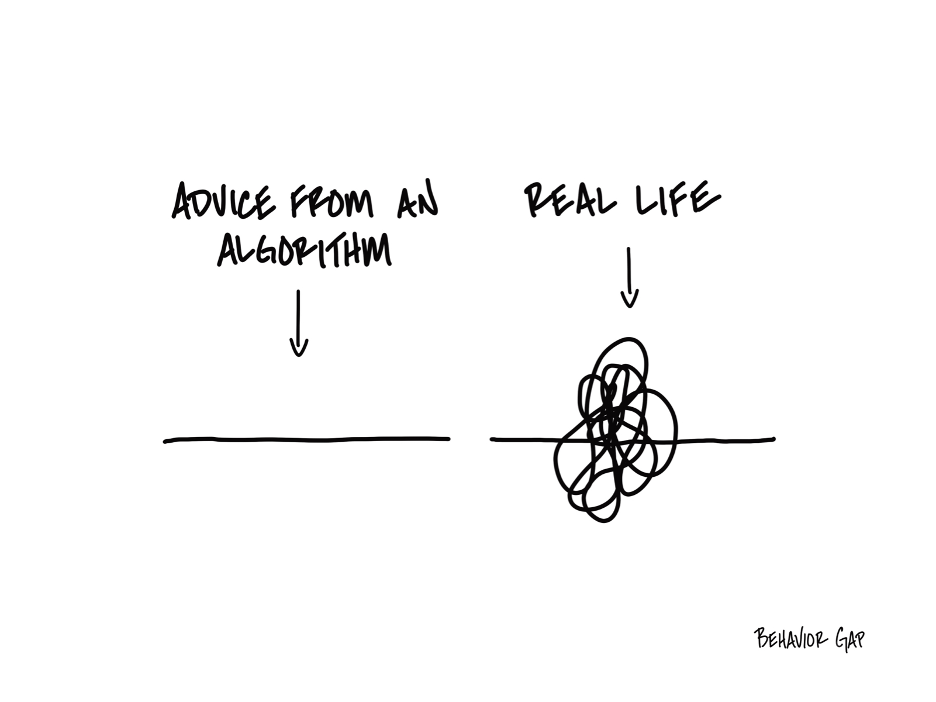

AI and Real Life

Humans don’t fit into an algorithm.

This is particularly true when it comes to humans and their money.

“Humans + Money” is a messy little cocktail.

An algorithm assumes that people make rational decisions. That they stick to a plan. That they follow rules.

But real life doesn’t work like that.

People panic when markets fall. They get overconfident when markets rise. They spend based on emotions. They hesitate when they should act.

An algorithm doesn’t know what it feels like to watch years of savings drop in value overnight. It doesn’t know the fear of running out of money in retirement. It doesn’t know the regret of a missed opportunity.

Real investors don’t operate on spreadsheets.

Real investors live in the real world, where life is unpredictable.

The difference between good investment advice and great investment advice is understanding this reality.

Great investment advice isn’t just numbers, charts, and models.

It’s understanding the emotions behind the money.

It’s about guiding people through uncertainty. Helping them stick to their plan when they want to run. Giving them the confidence to take action when fear is holding them back.

It’s about recognizing that real life is messy. And that’s okay.

Investing success isn’t about eliminating the mess.

It’s about having someone who helps you navigate through it.

and then tap on

and then tap on

0 Comments