Owning a Nation’s Future

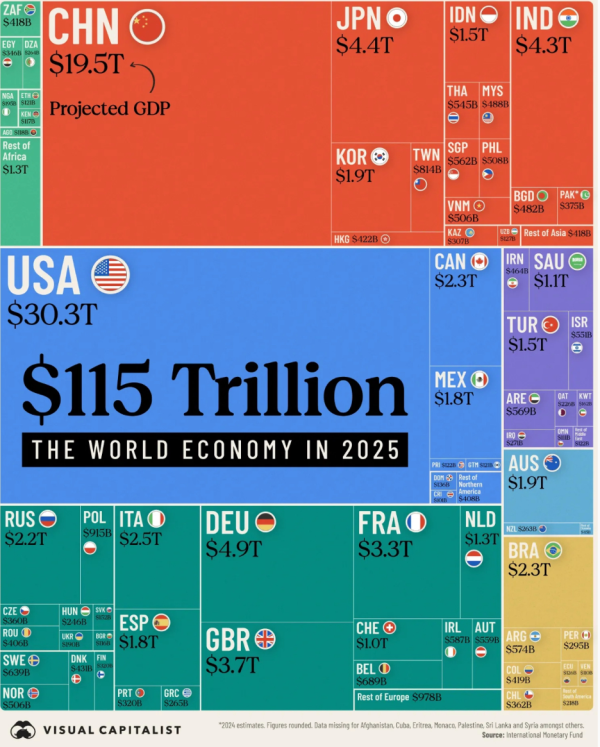

The US has been the world’s largest economy for more than 100 years, and will maintain its lead, in 2025 with a GDP of $30.3 trillion. China also holds its 2nd position with a $19.5 trillion GDP. Germany has surpassed Japan to come in at number 3. At number 5, is none other than India.

India’s economic story is nothing short of extraordinary. From being seen as a developing nation with potential, it is now emerging as a global powerhouse. By 2025, India’s GDP is projected to reach $4.3 trillion, making it the fifth-largest economy in the world. It recently overtook the UK and is on the cusp of surpassing Japan and Germany in the years to come.

India’s trajectory is not just a number on a chart; it’s a reflection of a nation that is reinventing itself. Over the next few years, India is expected to hit $5 trillion in GDP, and from there, the numbers get even more staggering: $7 trillion, $10 trillion, $20 trillion, and beyond. But this growth won’t be a straight line. Just like the stock market, there will be ups and downs, corrections, and pauses. Yet, the overall trend is upward, driven by the sheer momentum of its people, innovation, and entrepreneurial spirit.

The stock market is often a mirror of an economy’s growth. Over time, the Sensex and Nifty reflect the earnings growth of India Inc. and the expanding opportunities across industries. But stock market growth, like GDP growth, doesn’t happen without challenges. There will always be short-term setbacks (like the one we are witnessing now)—geopolitical tensions, inflation, policy changes, or global recessions. These hurdles create noise, but they don’t define the long-term potential.

India’s strengths are its demographics, digital infrastructure, and entrepreneurial ecosystem. With a young, ambitious population, India has one of the largest workforces in the world. This demographic dividend is a powerful engine of growth. Add to this the government’s focus on digital transformation—initiatives such as UPI, Aadhaar have fundamentally changed the way business is done in India. These are not just administrative reforms; they are catalysts for sustained growth.

Infrastructure development is another key pillar. From highways to airports, ports to railways, India is building the foundation for a modern economy. We just drove on a completed portion of the Mumbai- Delhi National Highway (NE – 4) and its absolutely world class. These investments in physical infrastructure will fuel industries such as manufacturing, logistics, and real estate, creating a ripple effect across the economy.

But GDP numbers and infrastructure projects are not enough. The real driver of India’s growth story lies in its companies—the businesses that innovate, adapt, and grow. Corporate earnings are the heartbeat of the stock market. Over time, the values of the Sensex, Nifty, and other indices are determined by the profits of the companies they represent. And while earnings growth may slow in one quarter or face pressure due to external factors, Indian companies have shown remarkable resilience.

We have seen this play out time and again. When faced with challenges, Indian businesses adapt. During the pandemic, many companies pivoted their strategies, cut costs, and embraced technology to survive and thrive. Similarly, during inflationary periods or economic slowdowns, companies find ways to protect their margins and sustain growth.

Take a moment to think about the sheer scale of what lies ahead. As India’s GDP grows, so does its stock market. The market capitalization of Indian companies will expand in tandem with the economy. But it’s essential to remember that this journey won’t be linear. There will be corrections, periods of underperformance, and global shocks. These are not reasons to avoid investing; they are opportunities to stay invested and even add to your portfolio.

Investing in India is a long-term game. As GDP grows, so will the wealth of those who remain patient and committed. There will always be reasons to hesitate. Markets might seem in a corrective phase. Headlines might scream doom. Predictions of a crash might dominate conversations. But as history has shown, the best time to invest is often when it feels most uncomfortable. Waiting for the perfect moment often means missing out on the journey.

India’s stock market reflects its economy’s dynamism and strength. It is not just a platform for trading; it is a gateway to ownership. Ownership of the businesses that are building the future, shaping industries, and driving change. By investing in India, you are not just betting on companies; you are betting on the collective potential of a billion plus people.

As we move into 2025 and beyond, India’s growth story will continue to unfold. It won’t be without challenges, but the opportunities far outweigh the risks. For investors, the question is simple:

Are you ready to be a part of this journey? Are you ready to invest in India’s future?

The Indian stock market is more than just numbers on a screen. It is a reflection of the country’s aspirations, efforts, and achievements. It is a reminder that while the path may not always be smooth, the destination is worth the journey.

So, as you think about where to invest your money, consider this: India is not just an emerging market; it is an emerging superpower. Its growth story is one of the most compelling in the world. And for those who have the vision to invest and the patience to stay the course, the rewards can be transformational.

Invest with purpose. Invest with conviction. And invest with the belief that India’s best days are ahead. Because they are.

and then tap on

and then tap on

0 Comments