The Swiggy IPO Mania

Here’s a question for you: What’s more important to you—making money or making good decisions?

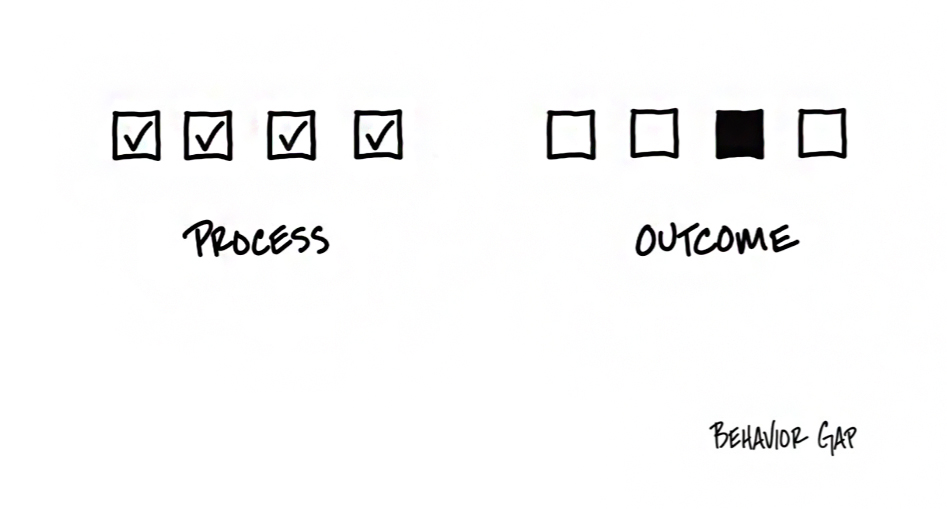

At first glance, it might seem like an either-or question. But it’s not. It’s an “AND” question. The correct answer is making good or great decisions and making money.

The point is to make money by making great decisions.

Because if you make money by making poor decisions, you’re likely setting yourself up for failure in the long run. You might get lucky once or twice, but eventually, you start believing this is how decisions should be made. You begin confusing luck with competence and intelligence. That’s where the real danger lies.

Great decisions, on the other hand, require a solid process. A clear framework for evaluating opportunities, managing risk, and understanding what you’re getting into. And this isn’t just about investing—it’s a life principle.

Yet so many investors I speak to either overlook this or, worse, don’t care. They want the outcome—money—without focusing on the process. They don’t explicitly say it, but their behaviour screams, “I don’t care as long as I make money.”

Let me give you a recent example.

A dear friend of mine called me excitedly one afternoon. “I want to invest in the Swiggy Pre-IPO Private Placement. Is this a good investment?” he asked.

Now, I’m always cautious when someone calls with an opportunity, especially one driven by excitement. So, I asked him, “Why do you want to invest?”

His reasons were:

- “The price is Rs. 345, and it’s expected to list at Rs. 700.”

- “Amitabh Bachchan has invested in this, and so have a few other famous people.”

- “I want to be on the cap table of this company.”

- “I think this will be a hit issue.”

I pressed further, “Are these the only reasons you want to invest?”

“Yes,” he replied. “Another reason is that Swiggy seems better valued than Zomato, and there’s a lot of demand for Zomato shares.”

I paused. Then I asked him, “Is Swiggy making money? How do they plan to make money long-term? You’re going to be locked in for six months—when are you planning to sell? What if the IPO doesn’t go as you expect?”

Silence followed.

Now, I’m a fan of Swiggy. I use their product all the time. But does that mean it’s automatically a great investment? Of course not. There’s a vast difference between being a consumer and being an investor. Loving a product doesn’t mean it’s a smart investment choice.

The real issue here, though, is how my friend was thinking about this investment. Were his reasons for investing solid? Or were they rooted in speculation, FOMO (fear of missing out), and a desire for social validation?

He might end up making money on the deal. Who knows? But does that mean he made a great decision? Probably not.

The distinction between making money and making great decisions is crucial. A lot of people focus purely on the outcome—how much money they made or lost—without reflecting on the decision-making process that got them there. It’s easy to justify a poor decision when the outcome turns out favourable. But luck isn’t a sustainable strategy.

Let’s break down why this happens:

1. Confusing Luck with Skill

When we make money on an investment, we often pat ourselves on the back and assume we made a good decision. But sometimes, luck plays a bigger role than we realize. The stock market, for example, has so many variables—some in our control, many out of our control. If you base your decision solely on the outcome, you could be reinforcing poor decision-making habits.

2. The Role of FOMO

FOMO is one of the biggest drivers of bad investment decisions. You hear that everyone is investing in a hot new stock or a pre-IPO deal, and you don’t want to be left out. This emotional driver leads people to invest without doing proper research or asking the right questions.

3. Seeking Social Validation

People love to feel like they’re part of an exclusive club. Being able to say, “I’m on the cap table of Swiggy” feels good. It’s a form of social validation. But investing for social status, rather than financial gain, is a dangerous game.

4. Ignoring Fundamentals

In my friend’s case, he didn’t ask key questions like, “Is the company profitable? How does it plan to grow? What are the risks?” Instead, he focused on the hype, the potential short-term gains, and the fact that celebrities were involved. But sound investing is about understanding the fundamentals of a business—not just following trends.

5. Short-Term Thinking

Many investors are focused on the next six months or the next year, rather than the long-term prospects of their investments. In my friend’s case, he was thinking about flipping his shares after the IPO, rather than holding for the long term. While there’s nothing inherently wrong with short-term trading, it requires a different set of skills and a tolerance for higher risk. But often, people get caught up in short-term thinking without fully understanding the consequences.

6. Overconfidence

Sometimes, a few successful investments lead people to believe they’ve got it all figured out. This overconfidence can blind them to the risks of future investments. They stop doing their homework, assuming they’ve already mastered the game. But investing is complex, and the market can turn on a dime. It’s essential to stay humble and diligent.

The Importance of a Process

To make great decisions—whether in investing or in life—you need a process. You need a framework for evaluating opportunities, assessing risks, and understanding your own emotional triggers (and blind spots). This process helps you make decisions based on data, not just emotion or social pressure.

A solid investment process might include:

- Understanding the business model: How does the company make money? Is it profitable? What are the risks to its revenue streams?

- Evaluating management: Does the leadership team have a track record of success? Are they transparent about the company’s challenges?

- Analysing market conditions: What are the broader market trends that could impact the company? Are they in a growing industry, or is competition fierce?

- Assessing your own risk tolerance: How much are you willing to lose? Do you have a plan if the investment doesn’t go as expected?

If you don’t have a process, you’re just gambling. And while gambling can be fun in the short term, it’s not a sustainable strategy for building long-term wealth.

What’s the Right Approach?

Before making any investment, ask yourself:

- Am I making this decision based on emotion or logic?

- Have I done my homework on this company?

- Am I influenced by FOMO, or do I have solid reasons to believe in this investment?

- What’s my exit strategy if things don’t go as planned?

- How does this fit into my overall financial plan?

These questions will help you make better decisions—whether you’re investing in a hot pre-IPO deal or simply making investments.

Making money is important. But making great decisions is even more important. When you make money through good decisions, you build a sustainable foundation for long-term wealth. But when you make money through luck or poor decisions, you’re setting yourself up for potential disaster.

In the end, it’s not about the short-term gains. It’s about building a process that helps you make great decisions consistently. That’s how you create lasting financial success.

So, the next time someone offers you a “can’t-miss” investment opportunity, stop and think. Are you making this decision because you’ve done your homework, or are you just chasing a quick win?

Great decisions lead to great outcomes. And that’s what investing should be about.

and then tap on

and then tap on

0 Comments