The Third Risk

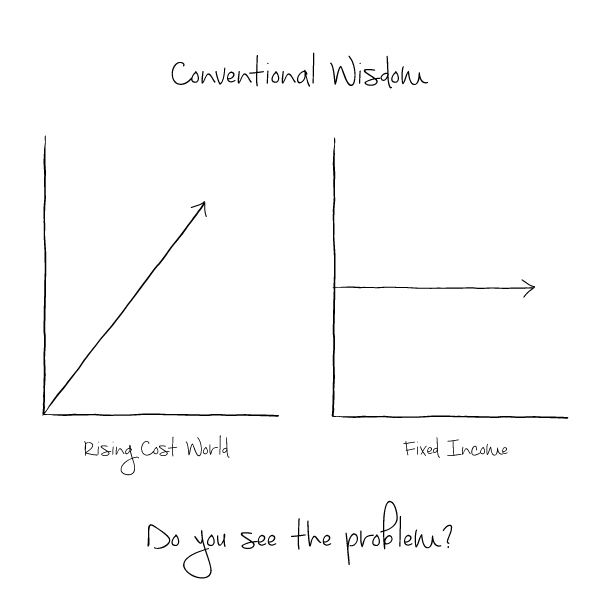

Most investors consider the stock market volatility (ups and downs) as risk… However, that is a naïve (or uninformed) way to look at risk. There are 3 real risks for most investors. I have shared two of them in the sketch below. Any guess on what the third one is.

Let me give a hint in the form of a sketch…

Did you get the 3rd Risk?

An inability to protect purchasing power…An inability to maintain lifestyle… We are all exposed to rising costs whether we like it or not. You can never ever beat rising costs or manage it with fixed income or fixed deposits.

I hope the above sketch brings the third risk to life.

and then tap on

and then tap on

0 Comments