On Selling Out – Part 2

“The more I thought about selling, the more convinced I have become that there are 2 main reasons why people sell investments: because they are up and because they are down”, wrote Howard Marks.

Let’s now look at the first reason – Selling because they are up.

Mr. Mark writes ““Profit-taking” is the intelligent sounding term in our business for selling things that have appreciated.”

So why do people really do it?

Investors do it because they like to see the gains. They are afraid that these gains might go away.

Advisors do it because they are also afraid that the gains might go away. They also want to show gains to investors to demonstrate how valuable they are. They might even look like idiots if they don’t. What if in a cocktail party someone says to their clients, “My advisor (or I) did profit booking. Yours didn’t. How lame?” Which advisor or distributor wants to hear this or be in an uncomfortable conversation like this?

Mr. Marks adds “Most people invest a lot of time and effort trying to avoid unpleasant feelings like regret and embarrassment. What could cause an investor more self-recrimination than watching a big gain evaporate? And what about the professional investor who reports a big winner to clients one quarter and then has to explain why the holding is at or below cost the next? It’s only human to want to realize profits to avoid these outcomes.”

It always feels good to look at realized gains. But the key question then is what do you do with those gains? Do you consume or Do you reinvest?

If you reinvest, you are again putting that capital to risk. So, what is really the point here? Doesn’t it simply boil down to market timing? Or interrupting compounding. Yes, one might argue that new investments might not go down because they are attractively priced, but again that is never a certainty.

He further writes “I am not saying that investors shouldn’t sell appreciated assets and realize profits. But it certainly doesn’t make sense to sell things just because they are up.”

Now let’s turn our attention to – Selling because they are down.

“As wrong as it is to sell appreciated assets solely to crystallize gains, it’s even worse to sell them just because they are down”, he writes.

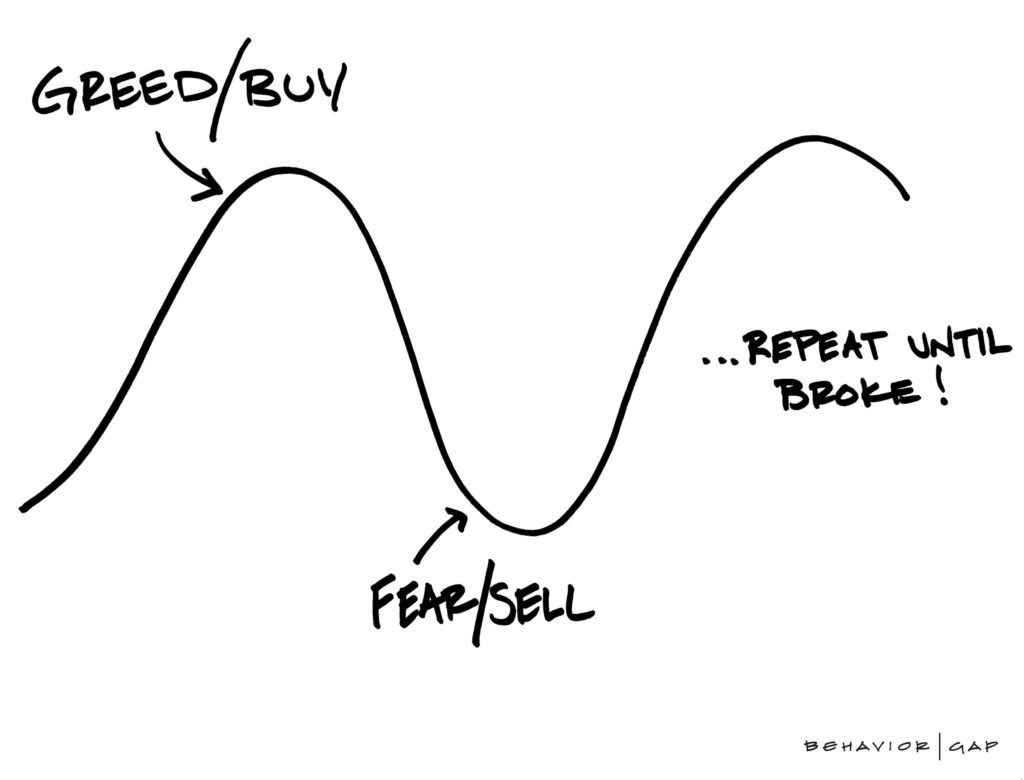

“While the rule is “buy low, sell high,” clearly many people become more motivated to sell assets the more they decline.

In a movie that plays in my head, the typical investor buys something at $100. If it goes to $120, he says, “I think I am on to something- I should add,” and if it reaches $150, he says, “Now I am highly confident- I am going to double up.” On the other hand, if it falls down to $90, he says, “I am going to think about increasing my position to reduce my average cost,” but at $75, he concludes he should reconfirm his thesis before averaging down further. At $50, he says, “I did better wait for the dust to settle before averaging further.” And at $20 he says, “It feels like it’s going to zero; get me out!”

Just like those who are afraid of surrendering gains, many professional investors (aka advisors) worry about letting losses compound. They might fear their clients will say (or they will say to themselves), “What kind of lame brain continues to hold a security after it has gone from $100 to $50? Everyone knows a decline like that can foreshadow further declines. And look – it happened.””

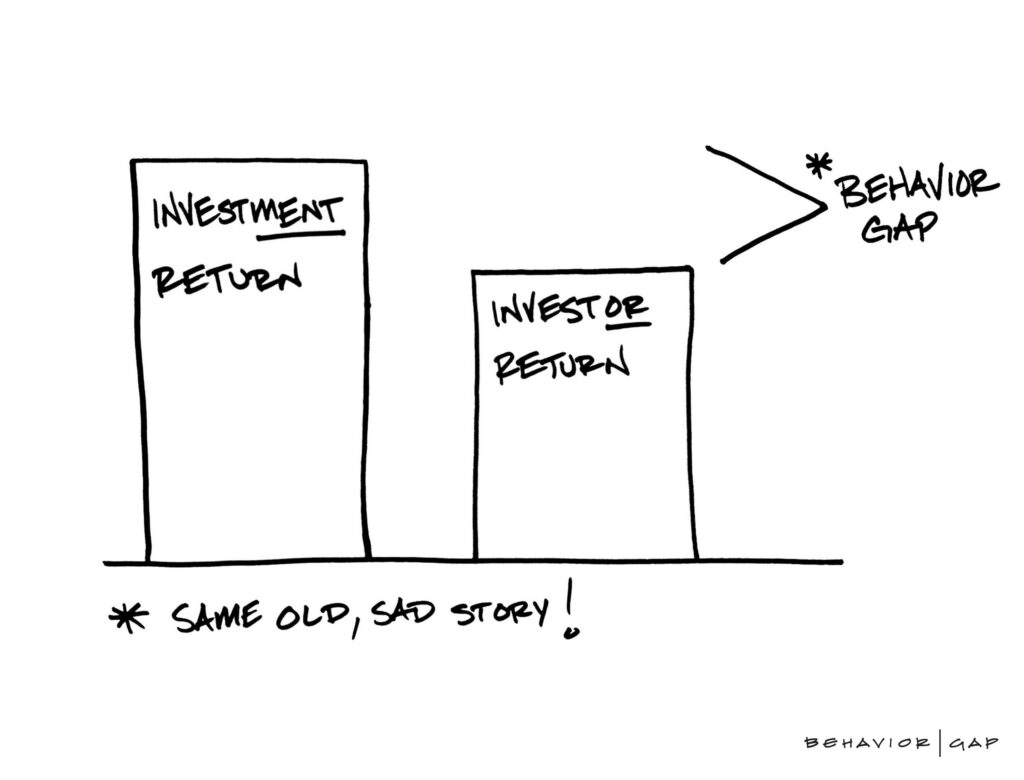

Thus, investors sell when they shouldn’t be selling and end up creating the gap between investment return and investor return. Like you all know by now, this is what is called the Behavior Gap.

Just like the Billy Markus (Founder of Dogecoin) example or the 200x Fund example that I gave above, there are countless examples of investors globally creating this behavior gap for themselves.

The Behavior Gap is real and various studies done in the US point this gap to be several percentage points. In fact, this is one of the biggest costs of investing that is never calculated by most investors.

Mr. Marks writes, “Superior investing consists largely of taking advantage of mistakes made by others. Clearly, selling things because they are down is a mistake that can give the buyers great opportunities.”

If you shouldn’t sell if investments are up and you shouldn’t sell because they are down, then when should you actually sell.

Well, this is the subject matter for Part 3.

In case you aren’t interested in waiting for Part 3, let me give you a hint – when you really need the money.

and then tap on

and then tap on

0 Comments