What’s More Important?

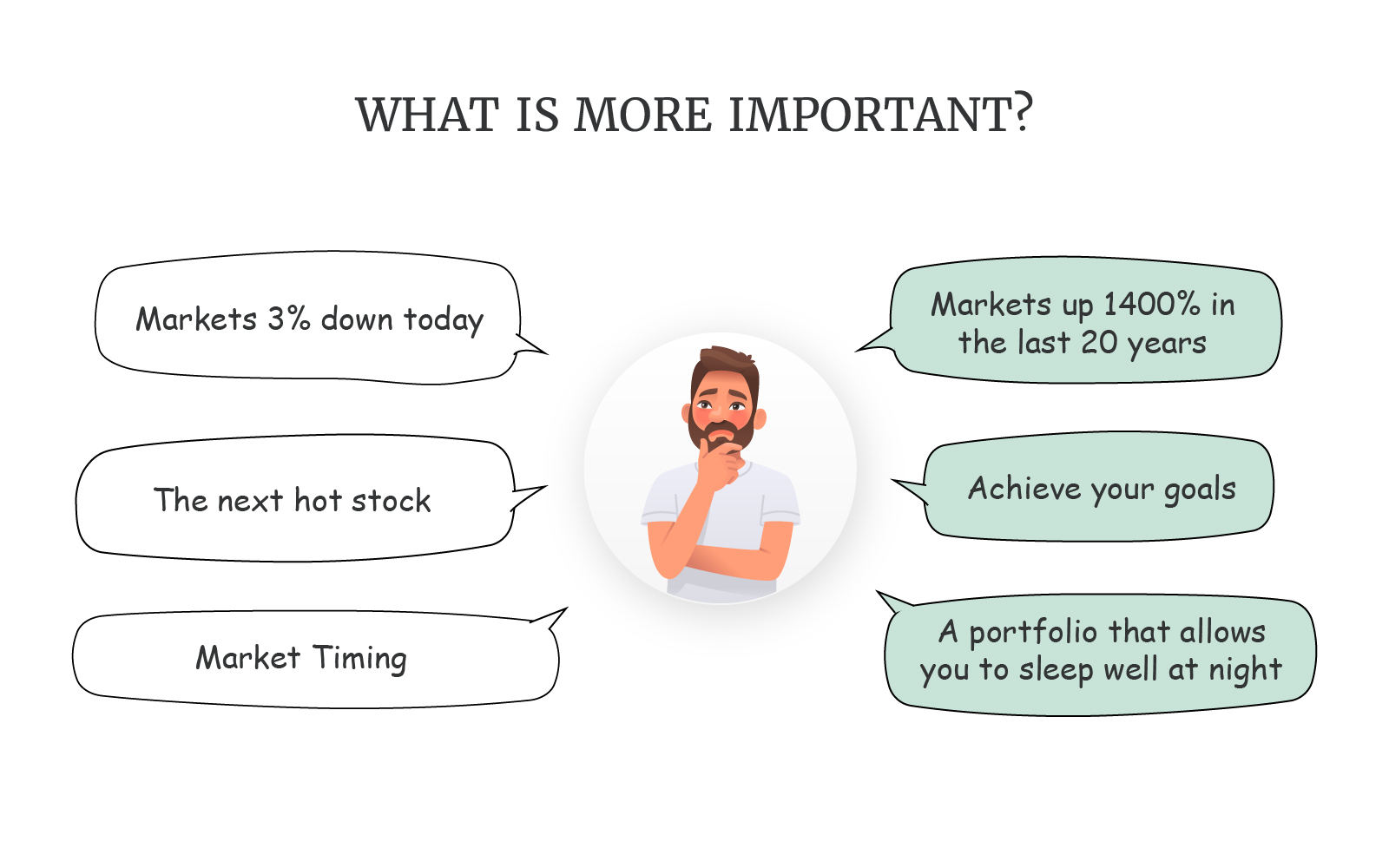

What’s more important?

That the market is down 3 percent today?

Or that it is up over 1400 percent in the last 20 years?

That you found the next hot stock?

Or that you built a portfolio that helped you sleep peacefully?

That you acted on the latest breaking news?

Or that you stayed the course long enough to achieve your life goals?

Most investors focus on the wrong side of the equation.

They get caught in the noise.

The daily news. The red arrows on the screen.

The social media buzz about some IPO.

The expert panel debating what the Fed will do next.

It all feels urgent.

But it is rarely important.

What matters is not what the market does today.

What matters is what you do consistently over the next decade.

What matters is not finding the next 10-bagger.

What matters is not interrupting compounding in your current one.

What matters is not predicting the top or bottom.

What matters is understanding why you are invested in the first place.

There is a reason most investors underperform the very funds they invest in.

Because they behave in ways that sabotage their own returns.

They jump around. They chase. They panic. They time.

They are always reacting.

Long-term investing is not about reacting.

It is about aligning.

With your goals. With your values. With your temperament.

The market will always go up and down.

There will always be a next hot stock.

And there will always be some expert telling you what to do.

But real success in investing is quiet.

It lies in tuning out the noise.

And tuning in to what really matters.

Ask yourself today.

Are you chasing what’s loud?

Or focusing on what’s lasting?

Because your answer might shape your future wealth.

and then tap on

and then tap on

0 Comments