This is Financial Wellness

Financial wellness is a term that we hear often, but defining it is not as simple as giving a number. It’s not a figure on a bank statement, a certain level of net worth, or a particular investment portfolio size. For many, it might feel like financial wellness is tied to numbers, but it’s much more than that.

It’s About How You Feel

Financial wellness is about how you feel when it comes to your money. Do you feel secure? Do you feel confident in the decisions you’re making? Do you feel at peace when you think about your financial future? These feelings matter more than the numbers themselves.

It’s about feeling good about where you are with your money. It’s about knowing that no matter what happens, you’re prepared. When you feel secure and confident, your financial life aligns with your personal values and goals.

Not Just Security, But Peace of Mind

Feeling financially well isn’t just about having enough money—it’s about having peace of mind. In fact, it’s not about having a lot of money. It’s about being able to handle unexpected financial shocks without losing sleep. You feel prepared to face any challenge, knowing that you have a plan in place.

This peace of mind comes from understanding your finances, knowing how to manage them, and making decisions that reflect your values. It’s not about being rich, it’s about being in control of your financial life. You don’t have to be a millionaire to feel financially well; you just have to know you’re making the right choices for you.

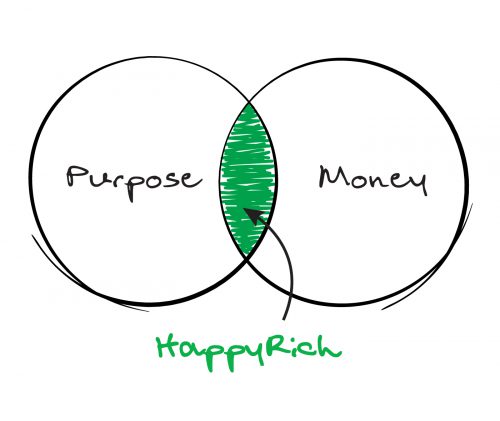

Living a HappyRich Life

At its core, financial wellness is about aligning your use of money with what’s truly important to you. This is where the idea of a “HappyRich” life comes in.

Being HappyRich means that your financial resources are in sync with your values, priorities, and long-term goals. You’re using your money in a way that reflects what matters to you most.

You don’t need to have the biggest house, the most luxurious car, or the largest portfolio. Instead, you need to feel that your money is serving you in the best way possible, whether that means spending time with loved ones, pursuing passions, or having the flexibility to make choices that bring you joy.

Financial wellness is not about comparison—it’s about alignment. It’s about knowing that your finances are structured to support the life you want, not the life others think you should have.

No Common Definition of Financial Wellness

One reason it’s difficult to define financial wellness is because it’s deeply personal. There’s no universal measure or standard for what financial wellness looks like. For one person, financial wellness might mean having a robust emergency fund. For another, it could mean being debt-free or having the freedom to travel.

We all have different financial situations, goals, and priorities. This means that financial wellness will look different for everyone. What’s important is understanding what it means for you and making sure you’re working toward that feeling of wellness.

Feeling Confident About Your Money Decisions

Part of financial wellness is feeling confident in the financial decisions you make. This doesn’t mean you won’t make mistakes. In fact, part of the journey to financial wellness includes learning from your missteps.

When you have a solid understanding of your finances and your goals, decision-making becomes easier. You can feel confident in your choices because they are grounded in what’s important to you. This confidence translates into a sense of empowerment. You no longer feel like your money controls you—you control your money.

Financial wellness means making decisions not from a place of fear, but from a place of understanding and alignment. It’s about knowing that you’re on the right path, even if that path includes ups and downs.

The Importance of Financial Education

Achieving financial wellness requires not just knowledge but more importantly it requires wisdom. You need to understand how to spend, how much to save, how to invest wisely, and how to plan for the future. Without this knowledge, it’s easy to feel overwhelmed or lost in the world of personal finance.

Educating yourself about money, whether through working with a real financial professional or reading up on financial topics, is key to building confidence. When you understand your finances and when you understand yourself (which is the most difficult part), you gain the power to make decisions that lead to financial wellness.

Financial education helps you avoid pitfalls, take advantage of opportunities, and create a strategy that aligns with your personal goals. The more you know, the better you’ll feel about your financial future.

Avoiding Financial Stress

Financial stress can be one of the biggest barriers to achieving financial wellness. When you’re constantly worried about your finances, it’s hard to feel at peace. Financial stress can stem from debt, uncertainty, or feeling unprepared for the future.

But financial wellness doesn’t mean you have to eliminate all stress. It’s about managing it. You can still feel financially well even if you have financial challenges—what matters is how you handle those challenges.

By having a plan, building an emergency fund, and staying focused on your long-term goals, you can reduce financial stress and replace it with a sense of control and security.

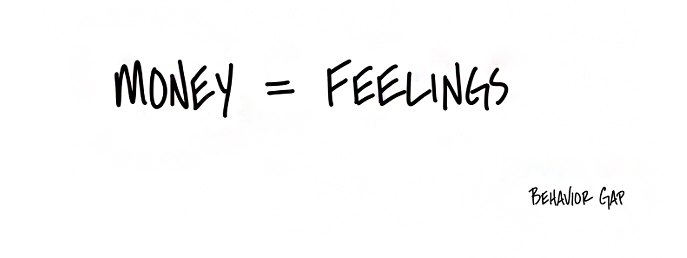

Behaviour and Financial Wellness

How you behave with your money has a huge impact on your financial wellness. It’s not just about what you know—it’s about what you do. Are you saving regularly? Are you sticking to your financial plan? Are you making conscious spending decisions?

Financial wellness requires discipline and intentionality. It’s about making choices that align with your goals, even when those choices are difficult. It’s about creating habits that support your financial well-being over the long term.

As Carl Richards, author of The Behavior Gap, says, “Money is not about math—it’s about feelings…it’s about behaviour.” Making good decisions consistently leads to financial wellness.

Building a Long-Term Plan

One of the hallmarks of financial wellness is having a long-term financial strategy and plan. A plan helps you navigate life’s uncertainties and stay on track toward your goals. Whether it’s planning for retirement, maintaining your lifestyle, saving for a home, or building an emergency fund, having a clear financial roadmap is essential.

A well-thought-out financial plan provides structure and direction. It helps you prioritize where your money goes, and it gives you peace of mind knowing that you’re prepared for whatever life throws your way.

Financial wellness isn’t just about where you are today—it’s about where you’re headed. A plan gives you confidence in your financial future and ensures that you’re making progress toward your goals.

Achieving Balance

Financial wellness is about balance. It’s about balancing short-term wants with long-term needs. It’s about balancing spending with saving, and planning for tomorrow while enjoying today.

Finding this balance can be challenging, but it’s crucial to financial wellness. It’s not about being overly restrictive with your spending, nor is it about indulging at every opportunity. It’s about making thoughtful decisions that support your overall financial health.

When you strike the right balance, you feel in control of your finances without feeling deprived or anxious. You’re able to live in the present while also preparing for the future.

The Emotional Side of Financial Wellness

Lastly, financial wellness isn’t just about money—it’s about emotions. Our relationship with money is often tied to our feelings of security, happiness, and peace. When we feel financially well, we’re not just managing our money—we’re managing our emotions around money.

Feeling confident and secure in your financial life reduces anxiety, boosts your mood, and allows you to live with purpose. Financial wellness brings emotional freedom. You’re no longer weighed down by worry or uncertainty.

As the sketch says, “Money = Feelings.” How you feel about your money plays a huge role in your overall sense of financial wellness. When you feel good about your financial choices, you feel good about your life.

Financial wellness is not a number—it’s a feeling. It’s about feeling confident, secure, and at peace with your financial life. It’s about aligning your use of money with what’s important to you and living a HappyRich life.

There’s no one-size-fits-all definition of financial wellness. It’s deeply personal and will look different for everyone. But at its core, it’s about being in control, making informed decisions, and feeling good about your financial future.

Start focusing on financial wellness today—not just on building wealth, but on creating a sense of peace and purpose with your money. You’ll find that when your finances align with your values, you’re not just financially well—you’re living a life of meaning and fulfilment.

and then tap on

and then tap on

0 Comments