Thinking Like a Sequoia: The Key to Becoming a Billionaire

What if I told you that even people of modest means can become billionaires?

Would you believe it?

Hold on to that thought till you finish reading this post. Here is a simple geography question.

Do you know the largest tree in the world (by volume)?

According to the United States National Park Service, “There are taller trees, and wider trees, but the General Sherman Tree contains more wood (volume) in its trunk than any other tree on Earth.” General Sherman is a giant sequoia tree located in the Sequoia National Park, California. Millions of people flock every year to this national park. While the overall park is simply outstanding, General Sherman Tree is the hero of the park.

Visitors queue to take a picture with the tree. They marvel at the enormity of this tree. I am short of words to describe how I felt in its towering presence. Are you wondering if this has anything to do with investing and becoming a billionaire? You are about to discover the profound connection in today’s post.

The General Sherman Tree has stood tall for over 2,200 years, witnessing the rise and fall of civilizations, the passing of countless seasons, and the ever-changing landscape around it. Its growth is a testament to the power of time, resilience, and long-term thinking. Investing, much like growing a giant sequoia, requires a perspective that goes beyond the immediate future.

Many investors struggle to achieve significant wealth because they fail to think like a sequoia tree. They focus on short-term gains, immediate gratification, and the here and now, rather than embracing the long-term potential of their investments. This myopic view limits their ability to grow their wealth to its full potential. An interesting insight is that even billionaires fail to remain billionaires.

The Illusion of Short-Term Success

Short-term thinking is common in today’s fast-paced world. Investors often chase quick profits, reacting to market fluctuations and news headlines. This behaviour is akin to planting a tree and expecting it to become a giant sequoia overnight. It’s unrealistic and unsustainable.

Consider the stories of Warren Buffett and Charlie Munger, two of the most successful investors of our time. Their investment philosophy revolves around long-term thinking, patience, and the power of compounding. Buffett famously said, “The stock market is designed to transfer money from the Active to the Patient.” Just as the General Sherman Tree didn’t become the largest tree overnight, significant wealth accumulation requires time, patience, and a long-term perspective.

The Power of Compounding: Nature’s Investment Strategy

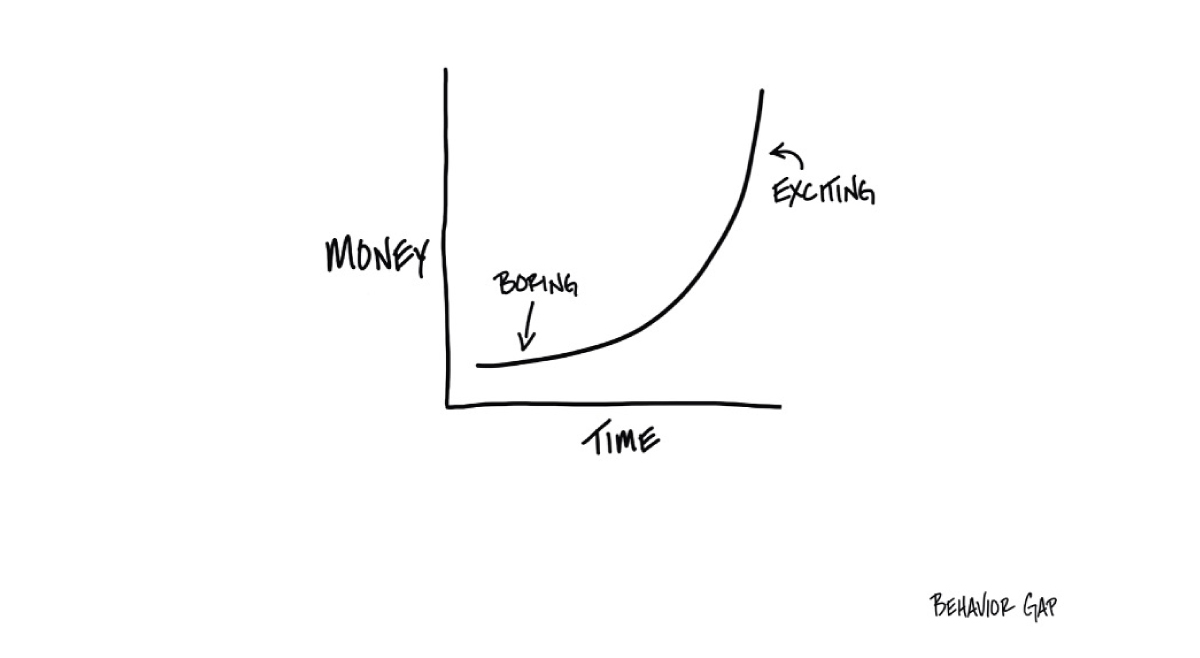

Compounding is the financial equivalent of the growth process of a giant sequoia. When you invest wisely and allow your investments to grow over time, the returns generated on your initial investment begin to generate their own returns. This snowball effect can lead to exponential growth, much like how the General Sherman Tree slowly but steadily grew to its monumental size.

Albert Einstein called compounding the “eighth wonder of the world,” stating, “He who understands it, earns it; he who doesn’t, pays it.” Unfortunately, many investors fail to harness the full potential of compounding because they don’t give their investments enough time to grow. Therefore, they pay.

In fact, the reason most of us don’t ever get to see this powerful force at work is because we are not willing to go through the boring part.

Things do get exciting eventually… look at the steep end of the curve.

It just takes a while to get there.

Unfortunately, the only way to get there is to go through the boring part of the curve first.

So be patient.

Very, very patient.

Thinking Beyond Yourself: The Legacy of Long-Term Investing

Investing with a long-term perspective also means thinking beyond yourself. Just as the General Sherman Tree stands as a legacy for future generations to admire and learn from, long-term investing can create a financial legacy that benefits not just you, but your children, grandchildren, and beyond.

Many people have enough wealth to meet their immediate needs and desires, yet they will never become billionaires because they don’t think like a sequoia tree. Their definition of long-term often extends only to their lifetime or, at most, includes their children. True long-term thinking encompasses multiple generations and the impact of your wealth on your family’s future and the world. It’s like having your own 150-year plan or a 500-year one.

The Missed Opportunities: Short-Term vs. Long-Term vs. Sequoia Long-Term

Consider the opportunities missed by those who focus solely on the short term. They might experience fleeting moments of financial success, but they often miss out on the profound benefits of long-term growth. Even those who focus on the long-term of 10 or 20 or even 30 years do not fully capture the true potential of their investments.

If these investors adopted the mindset of a sequoia tree, allowing their investments to grow and compound over decades, their financial outcomes would be vastly different. The ability to think long-term, to endure the market’s ups and downs, and to remain patient is what separates successful investors from the rest.

Implementing a Sequoia Tree Investment Strategy

How can investors start thinking like a sequoia tree? Here are some actionable steps:

- Embrace Patience: Understand that significant wealth accumulation doesn’t happen overnight. Be prepared to invest for the long haul, ignoring the noise of short-term market fluctuations. So be very very patient.

- Focus on Quality: Just as a sequoia tree grows slowly and steadily, invest in high-quality assets that have the potential to grow over time. This includes a diversified portfolio of companies with strong fundamentals, and other long-term investments.

- Reinvest Dividends: One of the most powerful ways to harness the power of compounding is to reinvest your dividends. This allows your returns to generate additional returns, accelerating your wealth growth.

- Think Generationally: Consider the impact of your investments on future generations. Plan your financial legacy to ensure that your wealth benefits your children, grandchildren, and beyond.

- Educate Yourself: Understanding the principles of long-term investing and the power of compounding is crucial. Take the time to educate yourself and avoid the pitfalls of short-term thinking. (Read the last two week’s posts here and here). Just an initial Rs.5,000 per month and then a monthly investment of Rs.5,000 at the rate of 12% can make anyone a rupee billionaire. Did your mind visualize that this was possible with only Rs.5,000 a month? But does this really happen in practice? Nope because we get in our own way by trying to find the best products, waiting for the right time to invest, trying to time the market and many other things.

- Stay the Course: There will be times when the market tests your patience and resolve. Remember the General Sherman Tree and its centuries-long journey. Stay committed to your long-term investment strategy, even during turbulent times. If necessary, write on a piece of paper and repeat, “This turbulence is normal.” Don’t forget to seek the care of a world class real financial professional.

The Timeless Wisdom of the Sequoia

The General Sherman Tree stands as a testament to the power of time, patience, and resilience. Its towering presence reminds us of the importance of thinking long-term, not just in investing but in all aspects of life. By adopting the mindset of a sequoia tree, investors can unlock the true potential of their wealth, creating a legacy that spans generations.

Many people have more than enough to meet their needs, yet they miss out on the opportunity to become billionaires because they don’t think like a sequoia tree. They fail to see the value of long-term investing and the power of compounding. Don’t let short-term thinking limit your financial potential. Embrace the wisdom of the sequoia, and watch your wealth grow to monumental heights.

and then tap on

and then tap on

0 Comments