The Wind That Powers Compounding

Most investors see volatility as something to be avoided at all costs. They crave smooth returns, steady lines, and absolute predictability. But avoiding volatility often turns out to be riskier than facing it.

Think of investing like a long ocean voyage. The calmer waters may feel safer in the moment, but they often move you too slowly. You stay comfortable but you never really cover distance. The rougher seas may feel uncomfortable, but they carry stronger winds. They push your sails farther, faster. Over decades, those winds make all the difference in where you end up.

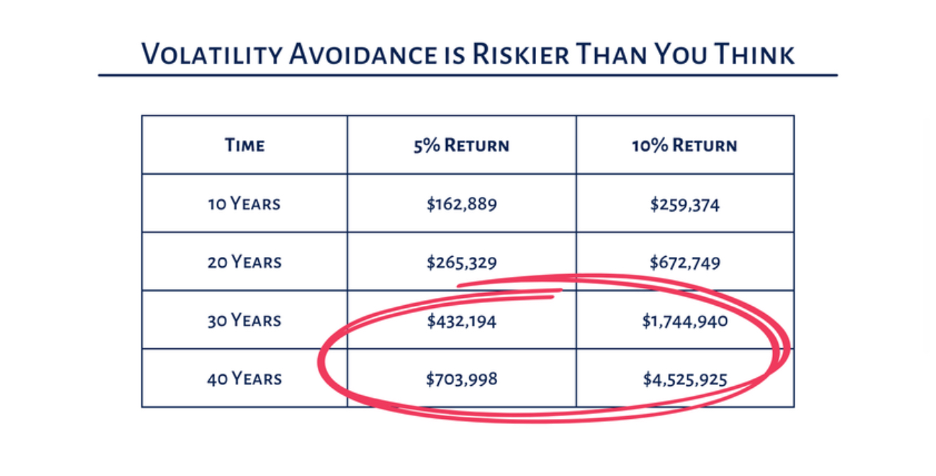

The table tells the same story. At a 5 percent return, your money grows, but slowly. Over 40 years, $100,000 becomes about $704,000. That looks fine until you compare it with the 10 percent return. The same $100,000, facing more volatility along the way, grows to over $4.5 million. The gap is staggering. It is the difference between staying afloat and truly changing your future.

This is the paradox of investing. The very thing most people try to avoid, volatility, is what makes higher compounding possible. Without accepting the storms, you cannot harness the winds.

Avoiding volatility may feel like protecting yourself, but over decades it quietly robs you of opportunity. It is like refusing to board the faster ship because you are afraid of waves. You may feel safe, but you never reach the extraordinary destination.

The real risk is not volatility. The real risk is running out of time without giving compounding a chance to work its full power.

Volatility is not the enemy. It is the wind in your sails. Without it, you drift. With it, you move forward. The voyage may feel uncertain at times, but it is the only way to reach the destination that truly changes your life.

and then tap on

and then tap on

0 Comments