The Shock Market

Webster defines “shock” as to cause surprise or a state of being disturbed. Every stock market investor knows that it is normal for the market to experience a temporary decline every year—yes, every year. We know this is normal. This is how growth happens. Then why are we surprised—rather, shocked—when a normal, temporary decline occurs?

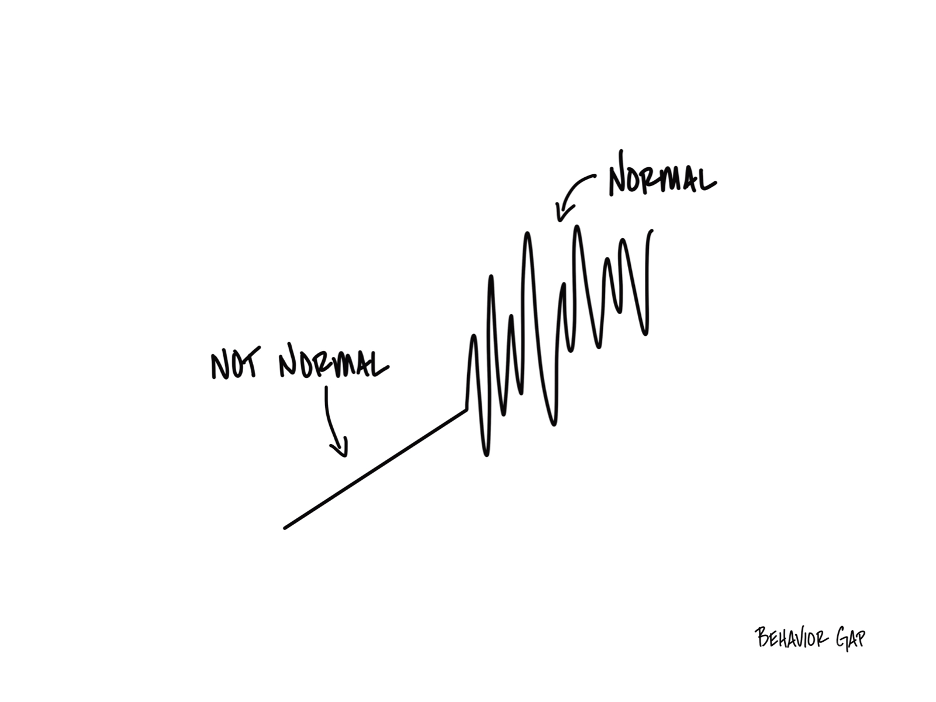

The stock market is not a shock market. Yet, many investors treat it as though it is. Every dip, every decline, every fluctuation is met with surprise, worry, or panic. But here’s the truth: the market is, in many ways, incredibly predictable. Not predictable in the sense that you can forecast what it will do tomorrow, next week, or next month. Predictable in the sense that its behaviour over time follows a rhythm, a pattern that repeats itself.

The stock market is predictable because it will never go up in a straight line. It rises, it falls, it moves sideways, but it never moves in one direction forever. That’s its nature. Markets breathe, just like we do. They expand and contract. They grow and correct. These movements are not anomalies; they are features. They are what make the market what it is.

If you understand this, you can prepare for it. You can embrace it instead of fearing it. The ups and downs are part of the process. They’re part of how wealth is built over time. To expect the market to only go up is to misunderstand its very essence. It’s like expecting the ocean to have waves that only rise but never fall. It’s unnatural and impossible.

But here’s the real insight: while the market’s short-term movements may feel unpredictable, its long-term trajectory is usually upward. History has shown us that declines are temporary. They are pauses, not endings. Advances, on the other hand, are permanent. They represent the growth of businesses, economies, and innovation. They reflect human progress, which, despite setbacks, is relentless.

Why, then, do investors panic? Because they forget this predictability. They get caught up in the moment. They listen to headlines that scream doom and gloom. They see red numbers and assume the worst. Fear clouds their judgment. They start to believe that the decline they’re experiencing is different, that it’s the one from which the market will never recover.

But this thinking is flawed. The market always recovers. Not because of luck, but because of its design. The stock market is a collection of businesses, and businesses are built to grow. They innovate, they adapt, and they find ways to create value. Even in the face of challenges, businesses find a way forward. This is why the market has always trended upward over the long term.

Understanding this predictability can change the way you invest. It can help you stay calm during downturns. It can keep you focused on the big picture, rather than the daily noise. It can remind you that every decline is temporary and that your patience will be rewarded.

The market’s declines are often misunderstood. Investors see them as losses, as failures, as reasons to abandon their plans. But declines are natural. They are opportunities. They allow you to buy more of what you believe in at lower prices. They are like sales at your favourite store. Yet, instead of seeing them as chances to invest wisely, many investors sell in fear. They turn temporary declines into permanent losses by locking in those losses and missing the eventual recovery.

This is why staying invested is so critical. When you sell during a decline, you’re not protecting yourself. You’re handing over your wealth to someone who is willing to stay the course. You’re giving up your opportunity to benefit from the market’s recovery. And recover it will, because that’s what it has always done.

But patience is hard. It requires faith in the future. It requires understanding that the market’s predictability is not in its day-to-day movements but in its long-term trends. It requires discipline to tune out the noise and stick to your plan.

Investing is not about avoiding declines. It’s about being patient with them. It’s about seeing them for what they are: temporary interruptions in a long journey of growth. The market’s predictability lies in this very pattern. It goes down, but it always goes back up. The key is to stay invested long enough to see the upturns.

The stock market rewards those who can embrace its nature. Those who understand that volatility is a feature, not a flaw. Those who recognize that the price of long-term growth is short-term uncertainty. Those who are willing to stay patient when others are panicking.

If you want to succeed as an investor, you need to shift your mindset. Stop expecting the market to be a straight line. Stop fearing the downturns. Start appreciating the predictability of its patterns. Start seeing the long-term upward trend as the true signal amidst the short-term noise.

The stock market is not a shock market. It’s a growth market. It’s a market that reflects human ingenuity and progress. If you can stay focused on this, you’ll understand that the temporary is just that—temporary. And that the permanent is worth waiting for.

and then tap on

and then tap on

0 Comments