The Prize

British Irish comedian Jimmy Carr once said something brutally honest.

“Everyone is jealous of what you have got. No one is jealous of how you got it.”

It sounds like a joke.

But it is one of the most accurate observations about human behavior, success, and money.

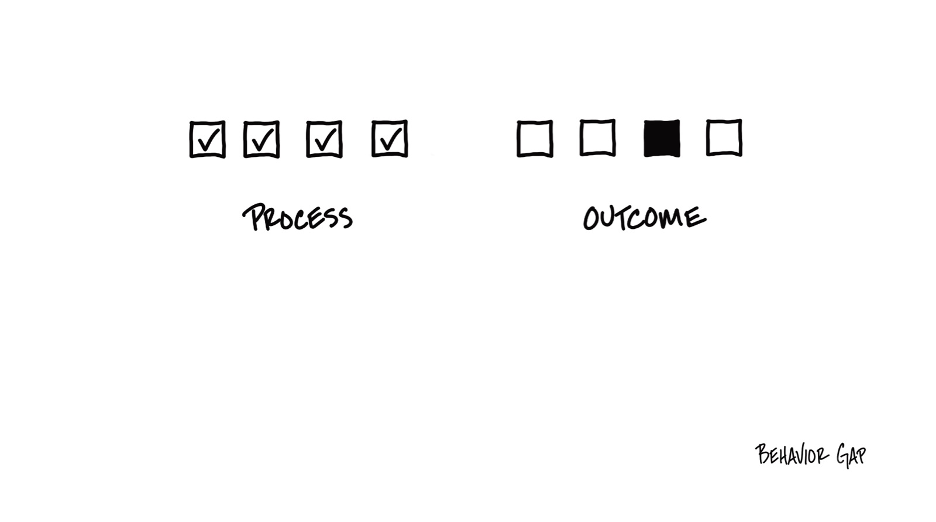

Everyone wants the outcome.

No one wants the process.

Everyone admires the destination.

No one wants to walk the path.

Everyone desires the comfort.

No one wants the discomfort that created it.

And this is not just true in careers or wealth creation.

It is especially true in investing.

Investors want the returns of a Warren Buffett.

But not the patience of a Warren Buffett.

They want the calm of a disciplined investor.

But not the discipline of a calm investor.

They want the rewards of long term compounding.

But not the long term.

They want the peak.

Not the climb.

They admire the billionaire.

But they do not admire the early mornings, the failures, the rejections, the sleepless nights, the years of obscurity, and the constant pressure that shaped the billionaire.

Everyone wants the outcome.

Almost no one wants the process.

And this gap is where most investors lose the plot.

The Result is Visible. The Process is Invisible.

This is true in every field.

People see an Olympic athlete win a medal.

They do not see the decade of training in rain, heat, injury, and pain.

People see a bestselling author on the front shelf of a bookstore.

They do not see the 500 rejected drafts or the 200 mornings when the author wrote with no inspiration at all.

People see a famous entrepreneur ring the bell at the stock exchange.

They do not see the years of uncertainty, debt, personal risk, and anxiety behind the scenes.

People see the mountaintop.

They do not see the climb.

Investing is exactly the same.

People see a 10 year chart that looks smooth.

They do not see the 10 years of fear, doubt, volatility, and temptation that investor lived through.

People see wealth.

They do not see patience.

People see compounding.

They do not see consistency.

People see results.

They do not see the routine.

In Investing, the Journey Matters More Than the Destination.

Every investor says they want great returns.

But few accept what great returns require.

Great returns require volatility.

Great returns require staying invested during fear.

Great returns require not reacting emotionally.

Great returns require ignoring noise.

Great returns require resisting temptation.

Great returns require patience that feels uncomfortable.

Everyone wants 15 percent returns.

No one wants to sit through a 20 percent correction.

Everyone wants their money to double.

No one wants the years it takes to double.

Everyone wants compounding.

No one wants to give compounding time.

Everyone wants the reward.

Few want the discipline.

The irony is simple.

The process you avoid is exactly the process that creates the return you desire.

The Pain You Avoid Is the Price of Admission.

Look at any successful investor.

Not their wealth today, but their process yesterday.

They all have one thing in common.

They embraced the discomfort that others avoided.

They stayed invested when markets fell.

They bought when others were terrified.

They ignored predictions.

They avoided shortcuts.

They were patient when others panicked.

They chose the process over the excitement.

They repeated simple behaviors even when they felt boring.

They were not chasing the outcome.

They were following the process.

The return came later.

Not because they were lucky.

But because they were willing to do what others avoided.

The reward is a byproduct of consistency.

The result is a side effect of the process.

Ask investors what they want.

They say high returns, safety, peace of mind, and long-term growth.

Ask them what they are willing to endure.

Suddenly the answers change.

Volatility? No.

Corrections? No.

Boring years? No.

Staying invested when the news is scary? No.

Ignoring social media advice? No.

Following a plan consistently? Maybe.

Trusting the long term? Depends.

They want the return of a 20-year horizon.

But they act with the mindset of a 20-minute horizon.

They say they believe in long term compounding.

But they check their investments every day.

They say they trust the India story.

But they panic during every dip.

They say they want financial freedom.

But they resist financial discipline.

They say they want great results.

But they want those results without discomfort.

This is the tragedy of modern investing.

Everyone wants to be a long term investor.

Until the long term feels difficult.

The Investor You Become Determines the Return You Receive.

Your investments grow only as fast as your behavior evolves.

Not the market.

Not the economy.

Not the product.

But your behavior.

Markets reward temperament, not talent.

They reward patience, not intelligence.

They reward calmness, not cleverness.

They reward consistency, not perfection.

Your portfolio is a mirror of your emotional discipline.

Not your financial knowledge.

The return reflects your ability to stay the course.

To endure boredom.

To tolerate discomfort.

To ignore noise.

To continue when others quit.

In other words, the return reflects the process you follow.

People love to quote the net worth of billionaires.

But how many would want their early life?

The uncertainty.

The sleepless nights.

The debt.

The criticism.

The failures.

The rejection.

The self-doubt.

The loneliness.

The sacrifice.

People admire the success but avoid the struggle.

Investing is the same.

Everyone wants the chart.

No one wants the volatility.

The investors who succeed are not special.

They are simply consistent.

They show up.

They automate.

They follow a plan.

They ignore noise.

They trust the process.

They think in decades, not days.

They allow compounding to work quietly.

And slowly, they reach a place others call luck.

But it is not luck.

It is behavior.

It is discipline.

It is patience.

It is understanding.

It is doing small things repeatedly for a very long time.

Ask Yourself:

Do you want the result?

Or do you want the process?

Do you want the peak?

Or do you want the climb?

Do you want the chart?

Or do you want the discipline?

Do you want the outcome?

Or do you want the behavior required?

Your answer determines everything.

Because investing is not really about returns.

It is about becoming the kind of investor who can earn those returns.

The market is the only place where you get rewarded not for wanting, but for enduring.

Not for wishing, but for behaving.

Not for predicting, but for persevering.

Everyone wants the destination.

But only those who walk the journey ever arrive.

Jimmy Carr was right.

People admire the outcome, not the effort.

But in investing, the effort is everything.

If you want better results, stop focusing on the result.

Focus on the process.

The returns will follow.

and then tap on

and then tap on

0 Comments