The Pretend Investor Disease (PID)

Last week, the news that dominated the Crypto world as well as equity markets was the fall of Stablecoin TerraUSD (UST). At a basic level, Stablecoins are meant to be stable with their value pegged to the price of a single asset, typically a fiat currency such as the US dollar. The simple point is that 1 US Dollar Stablecoin = 1 USD. When someone issues/mints a USD Token in the Cryptoverse, all that had to be done was to back the tokens with real dollars. But here was a Stablecoin UST that lost its peg to the dollar and went all the way to ZERO. Thus, giving rise to “The Unstablecoin and shaking up the entire crypto ecosystem.“

The initial generation of Stablecoins USDT, and USDC maintained their price using a basket of assets including dollars. Why a basket of assets and not simply dollars is beyond me. But let’s keep that aside for a moment. This new generation Stablecoin UST, produced by Terraform Labs was an algorithmic Stablecoin. This meant that it didn’t directly hold dollar reserves but instead maintained its peg to the US dollar through a network of arbitrageurs, who buy and sell Terra’s volatile cryptocurrency LUNA. LUNA was also a governance token that granted holders voting power over the protocol. I know this is getting a little technical, but I had to provide some context here. Back to plain simple English now.

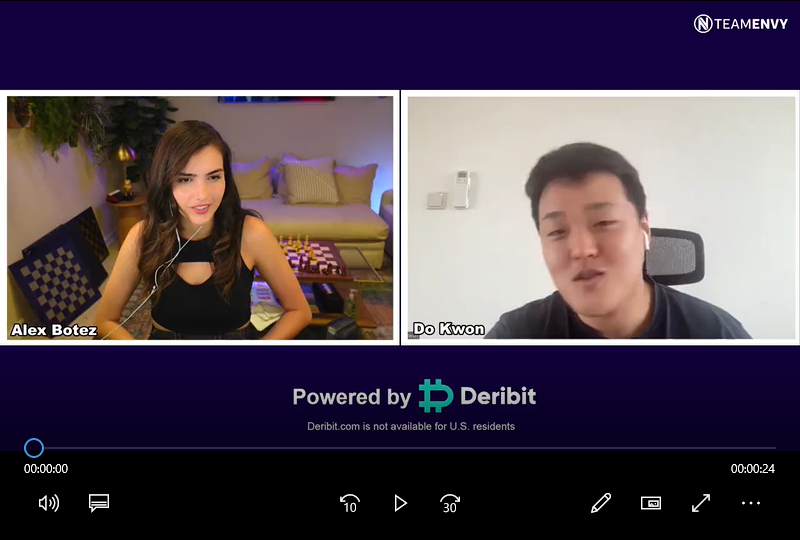

Terraform Labs (the creator of the Terra ecosystem) was founded by Do Kwon and Daniel Shin. Watch a 25 second video of an interview in which Do Kwon says “95% of coins are going to die, but there is also entertainment in watching them die.”

And people were betting on this arrogant fellow with their life savings. When LUNA was going up in value, there was a lot of noise around how this was the next big invention. Crypto Billionaire and ex Goldman Banker, Mike Novogratz had revealed his LUNA tattoo on Twitter (in January) claiming “I am officially a LUNATIC.” There were many others who were touting their LUNA returns. People get sucked into all this media hype and noise. The lure of making quick money is so strong that many people end up pretending to be investors.

The following is a message from the Center for Personal Finance Disease Control (CPFDC) about a particularly dangerous virus called Pretend Investor Disease (PID). This virus is highly contagious and goes from one person to many quickly. If left untreated, PID can suck your investments dry. It works by convincing you to buy an investment at a silly price for no other reason than the hope that it will continue to go up in price, so you can sell it to someone else at an even sillier price.

And Many People don’t even learn a lesson from this.

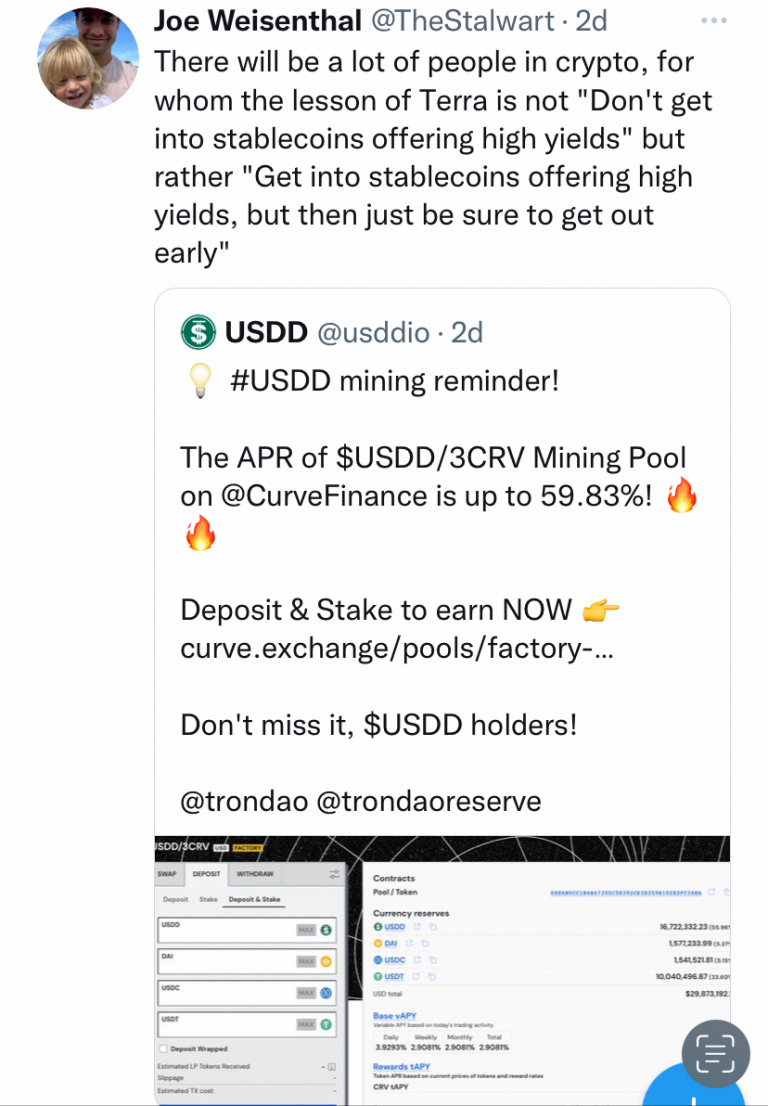

Joe Weisenthal tweeted in response to the launch of yet another algorithmic Stablecoin USDD (by another cocky fellow Justin Sun) “There will be a lot of people in Crypto for whom the lesson of Terra is NOT ‘Don’t get into Stablecoins offering high yields’ but rather Get into Stablecoins offering high yields, but then just be sure to GET OUT EARLY”.

This goes to show that PID mutates into different variants with every variant more contagious than the previous one.

There is actually a name for the behaviour PID causes – The Greater Fool Theory. It’s the idea that we can get away with doing something foolish because we assume that somebody else is going to come along and be even more foolish.

The more you hang around with pretend investors, the more you will be exposed to PID spreading agents like tips, insider tips, hot investments and hashtags.

If the thought “I am going to buy this and hope it keeps going up,” occurs to you, you may already be infected. So are investors who simply buy investments because they will go up faster than everything else.

If you are infected, here is your Vaccine.

- Stop what you are doing on the investment front immediately.

- Do Not Buy That. Investment!

- Seek Help from a trained professional (a Real Financial Professional).

The only way to combat PID is by becoming a real investor. An investor who is driven by a process and is goal focused. An Investor who is not driven by investment prices or by what people around him are doing. An investor who behaves well during the markets that we are witnessing now or the bullish ones that we witnessed earlier. An investor who embraces volatility for this is the only rational way to capture the upside of equities in a consistent manner.

Every single successful investor has had portfolios that were beaten down. Unlike the Pretend Investors, the successful investors do not give up during bear markets. They don’t sell at the first sign or last sign of trouble. Warren Buffett’s portfolio is down too this year. He didn’t sell, rather he bought. He upped his stake in Apple buying another 3.8 million shares (after a 3-day drop). Apple now accounts for 42.8% of the Berkshire Hathaway portfolio.

Which type of investor are you?

A Pretend Investor or a Real One!

and then tap on

and then tap on

0 Comments