The Paradox of Inaction

I heard an interesting line on a podcast- It’s amazing how physically exhausting it is to do nothing.

Have you ever noticed/observed this phenomenon?

I don’t know whether you have noticed this…but we all have observed a similar phenomenon in the world of investing, where it’s emotionally exhausting to do nothing…It’s emotionally exhausting to do nothing when the stock market is going up…It’s even more emotionally exhausting to do nothing when the stock market is sliding down or going nowhere for months or years.

However, I am certain that you might have experienced some version of this (there are always exceptions such as the readers of this blog 😊)…

It’s emotionally exhausting to do nothing… that’s why most people cannot behave…

We believe doing nothing means we are helpless…We believe doing nothing means we are not in control…We believe doing nothing means we don’t know what to do…We believe doing nothing means our financial professionals are clueless about what to do either…

And we don’t want to feel helpless…We want to do something…We want to believe we have control…that’s why we look for people who we think know what to do…we look for people who we think have control.

And we just cannot sit tight doing nothing…

As Blaise Pascal said, “All of humanity’s problems stem from our inability to sit quietly in a room alone.” In the context of investing – “Most (if not all) of our investing problems stem from our inability to let compounding work for us.”

This is exactly the reason why we see these visuals in action all the time…

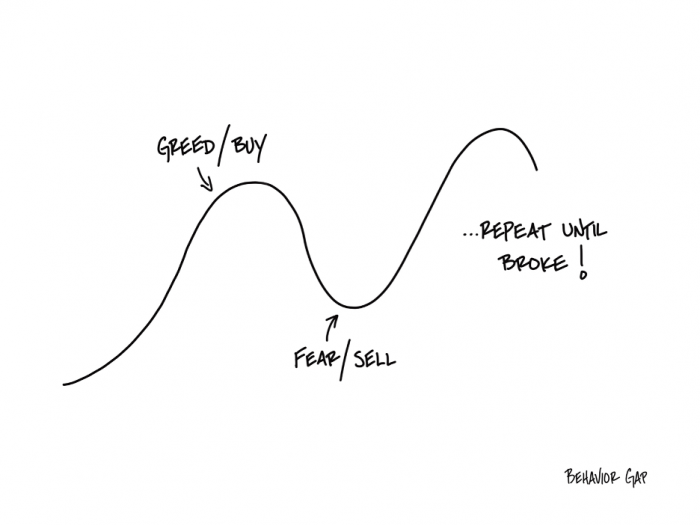

Most of us make the same mistake with our money over and over: we buy high out of greed and sell low out of fear.

Just look at mutual funds.

At the top of the market, we can’t buy fast enough. At the bottom, we can’t sell fast enough. And we repeat that over and over until we stop believing in the stock markets.

Have you heard anyone say, “The stock market is not for me…Or I am not lucky with stocks/equities…or I have lost money in mutual funds. I am never going to invest. I will only do real estate…

People who do this are unable to see their blind spots, biases, and behavior when it comes to investing…Therefore many get into something I had written about earlier – Volatility Laundering…They go for Real Estate naively believing it’s safe…I will be writing an interesting take on this soon…

Can you imagine doing this in any other setting?

If something gets cheaper, we feel the excitement…If something we desire falls further, we are excited…but investing is the only place where we aren’t excited…we can’t even sit still…we become fearful…we become insecure…we somehow believe we are going to lose it all…

Why?

Because we have a complicated relationship with money…We don’t understand it well enough…Even many millionaires and billionaires don’t understand the intersection of money and its meaning in their lives that well…How many do you think can answer this question well – What does money mean to you or what’s important about money to you or what role does money play in your life?

Look, I get it.

We’re hardwired to get more of what gives us security and pleasure and run away as fast as we can from things that cause pain. That behavior has kept us alive as a species. Mix that with our desire to be in the herd, the feeling that there’s safety in numbers, and you get a potent cocktail.

When everyone else is buying, it feels like if we don’t join them, we’re going to get eaten by the financial version of a saber-toothed tiger.

But it doesn’t take a genius (or Warren Buffett) to see that this behavior is terrible for us when it comes to investing.

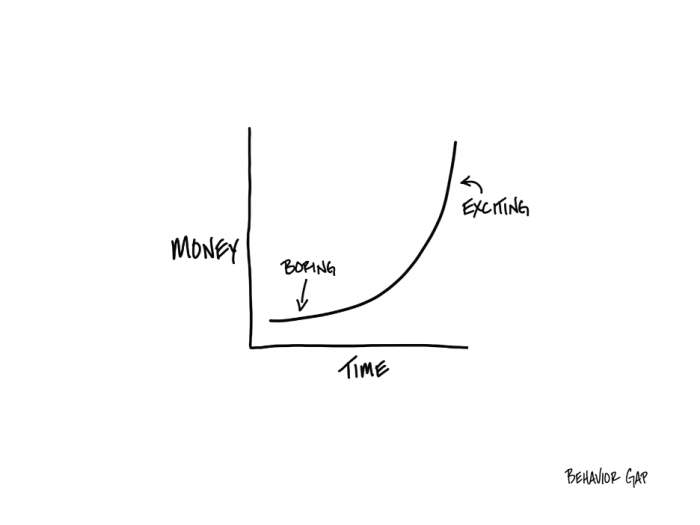

Real Investing is always boring in the short and the medium term. It really is…Compounding rarely lifts its head…You will feel as if nothing is really happening…That makes it even more difficult to do nothing…After all, your friend is bragging about his success with a hot investment…It seems like everyone is making it quicker than you…And that feeling makes it even more difficult to do nothing…

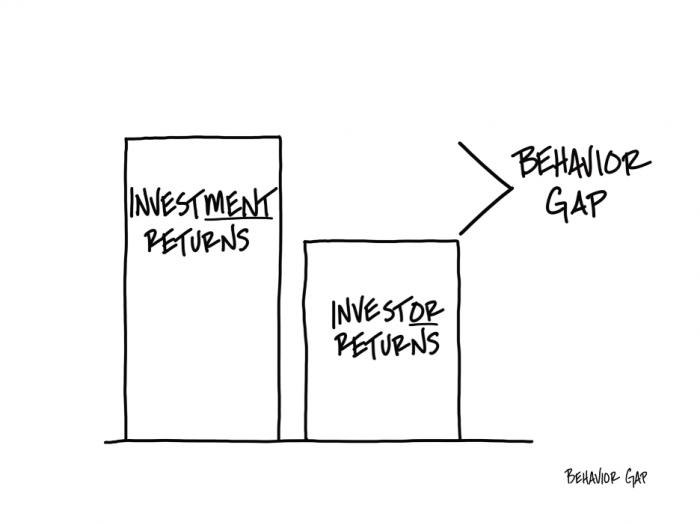

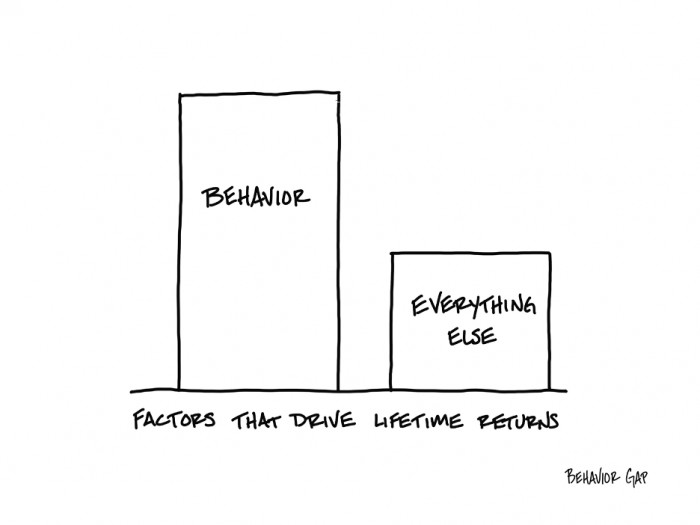

But as you might know, the single most important factor in a lifetime of successful investing is your own behavior.

You could have the greatest portfolio ever created. But one poor behavioral mistake a decade, and you might as well have just kept your money in the bank.

In fact, I would argue that portfolio design only matters to the degree that it influences your behavior.

So next time some hand-wavey person on the financial pornography network starts talking about how you should buy, sell, or do anything at all, just remind yourself: none of that matters if you don’t behave.

The reality though is that it’s not easy to behave in the presence of 24*7 financial pornography networks…Therefore as Benjamin Graham said, “The investors chief problem and even his worst enemy is likely to be himself.”

Warren Buffett – “It won’t be the economy (or the stock markets) that will do in investors; it will be investors themselves.”

As Nick Murray wrote – “Permanent Loss in a broadly diversified portfolio of quality equities held for the long term is a MYTH. That in fact when permanent loss occurs, it is always a human achievement, of which the equity market itself remains incapable”.

The questions then are: How do you ensure you behave? How do you ensure that nothing comes between you and your cherished financial goals/objectives?

The best way – the genuine care, guidance, and wisdom of a real financial professional.

A real financial professional who will help you find peace with your money…A person who will help you find contentment with your money and investments…A person who will come between you and your costly mistakes…A person who will help you become comfortable sitting patiently with your equity investments…

and then tap on

and then tap on

0 Comments