The Most Dangerous Place in Investing

Most investors are not stuck because of lack of information.

They are stuck because of indecision.

They keep researching. Then researching more. Then waiting for “just a little more clarity.”

The problem is clarity never fully arrives before the decision. It arrives after it.

There is a point beyond which more research does not give you better answers. It only gives you more anxiety.

In investing, excessive research often becomes a socially acceptable form of procrastination.

You tell yourself you are being “responsible.”

In reality, you are stuck in the infinite loop of “What if I am wrong?”

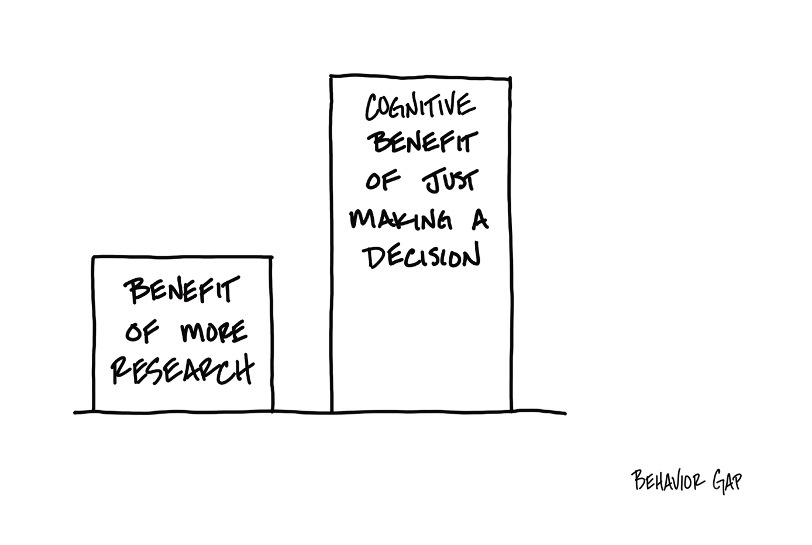

And here is the big insight: The cognitive benefit of finally deciding is often far greater than the benefit of waiting for more information.

The relief. The energy shift. The mental bandwidth it frees up.

That is priceless.

Because when a decision is made, your mind stops spinning.

Doubt is replaced by direction.

And action even if small begins.

Compounding can only start after a decision, never before.

The most dangerous place in investing is not being wrong.

It is being stuck.

Markets reward participation, not perfect timing.

You can course-correct along the way. You cannot compound indecision.

The goal is not to be 100 percent certain.

It is to be clear enough to begin.

If you are someone who has been thinking about investing, switching, allocating, diversifying and thinking for months, ask yourself a difficult but honest question today:

Do I really need more data? Or do I just need to decide?

Because sometimes, peace of mind does not come from more information.

It comes from finally moving forward.

and then tap on

and then tap on

0 Comments