The Greatest Bank Robber in The World

Last week, I was writing my take on an interesting question pertaining to stock market investing…Let me keep the question a secret just for a few paragraphs. After a couple of days, I came across an interesting story that I thought was deeply connected to this very topic. I believe the headline would have piqued your curiosity a bit, so let’s dive straight into the post.

Mike X in his book “Your Best Life” wrote this story of the greatest bank robber who ever lived.

“It was originally told by a spiritual teacher named Philip Berg (without some of the colorful details you will get from me here).

The bank robber’s name was Elvis.

Elvis robbed more banks and stole more money than anyone else in history. Every heist he pulled was more elaborate than all the ones that came before it.

He used tunnels, helicopters…all the stuff you see in the movies.

And he never got caught.

In fact, nothing bad ever happened to him…until- one day- he’s in the middle of the heist of the century, and he gets shot.

Elvis bleeds out on the floor and dies right there. Then he leaves his body and gets transported to a tropical paradise.

It’s like a five-star resort. And there at the welcome desk, a nice woman greets him and shows him around.

They have got everything you could possibly want – an endless buffet, a spa, fresh rose petals that appear in the toilet bowl after every flush…

It’s nice…Every room is the Presidential Suite.

She then asks him, ‘Is there anything else I can get you, sir?’

Elvis says, ‘Yeah…I used to rob banks, and I kind of liked doing it. Maybe you could arrange for me to rob a bank up here?’

She says, ‘Oh yes, absolutely. Which bank would you like to rob?’

He is excited now.

He tells her the name of the bank that he always wanted to rob, but it was like a fortress, so he never could.

She says, ‘Not a problem, sir. How much money would you like in the vault?’

He seems irritated but says, ‘Two hundred million?’

She’s putting all this into her iPad, and she says, ‘Two hundred million it is. When would you like to do this?’

He says, ‘Today, 2 p.m.?’

She hits a button on her iPad and says, ‘You are all set for 2:00 p.m. today. There will be 200 million dollars waiting for you in the safe, which will be unlocked. You can walk on in and pick it up. The bank staff will help you carry it out of the door.’

At this point, Elvis is shaking his head furiously. He’s like, ‘No, you are missing the point. I need to plan the heist. Get around the alarm system. Take care of the security guys. Crack the safe. Plan the getaway.’

Now she’s shaking her head. She says, ‘It doesn’t work that way here. Now that you are dead, things are a little different. You just tell us what you want, and you will have it.

He’s like, ‘You don’t understand. I am the greatest bank robber who ever lived. There is no thrill doing it this way. What kind of racket do you guys have going up here in Heaven?’

The woman gets an evil grin on her face, and she says to Elvis, ‘Who said this was Heaven?’

Look, the greatest lie we tell ourselves is that we want life to be easy. That we want to get what we want. That we want to win.”

Isn’t this what we tell ourselves in every area of our lives? We tell this lie when it comes to stock market investing too…

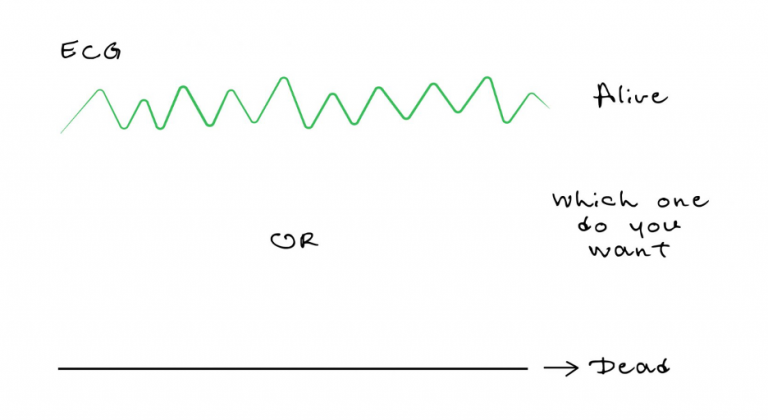

We want the stock market to only go up (while the market usually goes up, it goes down too). But we want it to be easy…We want a ride in one direction – to the moon…We want to see green (and high returns) whenever we open our portfolio reports…

Have you guessed the question that I was talking about at the start of the post?

I believe you have, but here it is anyway – What if the stock market only went up all the time? Another way to put the question is – What if the stock market never went down?

Now that you know Elvis’s story, do you really want this to happen…Beware what you wish for…

Imagine you are granted this wish…but remember this does not only apply to you but it applies to everyone.

The stock market chart resembles a never-ending escalator, moving in one direction — up.

At first glance, this might seem like the investor’s dream, a world without downturns, corrections, and bear markets. But let’s pull back the curtain on this hypothetical scenario to reveal the complex array of consequences.

In a market that only goes up, the fundamental principle of risk versus reward, which underpins our entire economic and financial system, would be rendered obsolete.

If the upward trajectory were guaranteed, the stock market would cease to be a market at all.

It would become a monotonous conveyor belt of guaranteed returns, stripping the thrill and strategy from investing.

In short, you would have converted this investment into fixed income or a fixed deposit.

The excitement of discovering an undervalued stock, the art of risk management, the wisdom of a well-diversified portfolio — all these would become relics of a bygone era. Investors would no longer need to do anything; they would simply buy and hold, forever.

Without the risk of loss, there would be no jubilation in gain, no sense of achievement…

Investing would become boring…

Moreover, this perpetual rise would likely inflate a bubble of unimaginable proportions. Without the usual ups and downs, without corrections to temper exuberance and rebalance valuations, the market would inflate endlessly until it detached entirely from economic realities. The price of assets would soar to stratospheric levels, far beyond any rational valuation or connection to actual company performance.

And what of the economic signals the stock market sends to company executives, investors, and policymakers? These signals would become meaningless noise. The stock market’s role as a barometer for economic health would be lost, and with it, the ability for companies to raise capital based on merit, performance, and potential.

In this strange world, the concept of investment strategy would be a remnant of a more volatile past. The ‘buy low, sell high’ mantra would be reduced to a quaint old saying, as every price would be low relative to the inevitable future price.

And let’s not forget the impact on wealth distribution. If the stock market only went up, the gap between the rich and the rest could widen dramatically. Those already holding assets would see their wealth grow exponentially, while those without the means to invest would find it increasingly difficult to participate in this growth.

Ultimately, an ever-rising stock market would warp the very fabric of investing, morphing it into a riskless, thoughtless activity.

The beauty of the market lies in its unpredictability, the intellectual challenge it presents, and the opportunities it offers for those willing to take calculated risks. Without the possibility of failure, success loses its sweetness, and without the shadows of downturns, the light of growth cannot be truly appreciated.

The ramifications of a perpetually bullish market would ripple across society, not just the financial sector. A world where the stock market only knows the upswing is a world where there would be no natural selection to weed out the weak companies from the strong. Innovation and efficiency thrive under pressure, under the need to perform and outcompete. But in this alternate reality, complacency could become the norm, and the incentive to innovate would diminish under the guaranteed security of an ever-appreciating market. More importantly there would be no incentives for people to innovate, take risks, and try to make a difference in this world…

In such a market, the value of money could become distorted. Inflation might spiral out of control as the continuous increase in asset prices disconnects from the actual value they represent. And for the average person, the dream of building wealth through savvy investing would become inaccessible, turning the stock market into an elite playground where the entry ticket is too steep for most.

Furthermore, this scenario raises profound questions about the very nature of work and reward. If financial growth is a given, the philosophical underpinnings of our work ethic, the sense of purpose derived from striving and achieving, could erode. The narrative of “working hard to get ahead” loses its meaning if “getting ahead” is a guaranteed outcome rather than an earned one.

Thus, while the allure of a stock market that only climbs might seem appealing, it negates the very principles that make investing an endeavor of skill, judgment, and sometimes, a bit of luck. The cyclic nature of the market, with its peaks and troughs, is not just a pattern of numbers but a reflection of life itself—dynamic, unpredictable, and full of lessons that help us grow not just financially, but in wisdom and character.

In the end, it’s clear that the stock market’s undulations are not obstacles to be wished away but valuable mechanisms that drive progress, reward perseverance, and teach prudence. They are the very essence of the economic pulse, and to wish for their absence is to wish away the heartbeat of progress.

Would you still wish for the stock market to only go up all the time?

and then tap on

and then tap on

0 Comments