Fear vs. Long-Term Truth

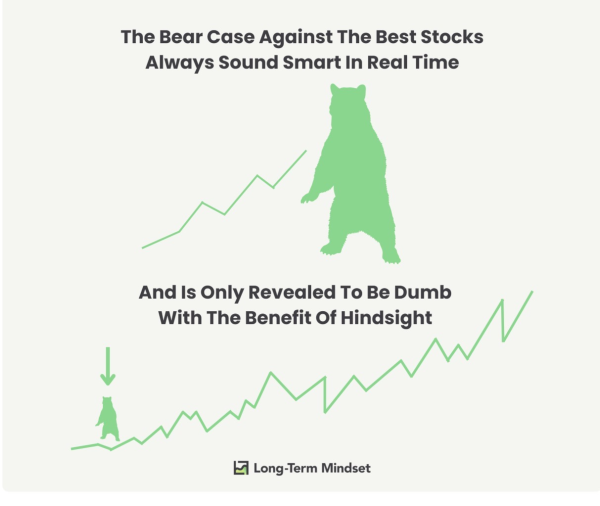

The bear case always sounds intelligent in real time. It uses complex words. It quotes macro data. It predicts doom with confidence. It is wrapped in logic and delivered with conviction. In the moment, it feels like the safe and sensible thing to believe.

Years later, when you look back, most bear arguments are revealed to be noise. They were smart sounding stories built on temporary problems. What looked like a mountain in the moment often turns out to be a small bump in a much larger upward journey.

This is the strange thing about investing. Fear feels more intelligent than optimism. Negativity sounds analytical. It feels like the person warning you is more sophisticated than the person who quietly believes in long-term growth. The pessimist seems smart. The optimist seems naive.

History tells a different story.

The world keeps moving forward. Companies keep innovating. People keep consuming. Human ambition keeps compounding. Stock markets, with all their volatility, keep climbing over decades.

Yet every year the same pattern repeats itself. Investors get trapped in short term narratives. They react to headlines. They confuse temporary pain for permanent damage. They underestimate resilience. They forget that every great company has lived through multiple bear cases that sounded brilliant in the moment.

Think about Apple, Amazon, Netflix, or even the stock markets. Every one of them has been declared overvalued, finished, broken, or doomed at some point. Yet the long-term investor who stayed the course has been rewarded for patience and conviction.

The bear case often wins the argument in the short term. But long-term investing is not a debate competition. It is an endurance game. The winners are not the best forecasters. The winners are the ones who refuse to let temporary fear override long term truth.

If you believe in the growth of businesses and the growth of an economy, then short term pessimism is just background noise. The real work is staying invested while others get carried away by fear.

In hindsight, the bear case always looks foolish. In real time, it just sounds clever. The investor who understands this difference is already ahead of ninety percent of the market.

Stay focused. Stay patient. Stay invested.

and then tap on

and then tap on

0 Comments