Corrections in Every Bull Run: A Natural Market Phenomenon

Investors, both seasoned and novice, often find themselves caught in the euphoria of a bull market. The steady upward march of stock prices, the promise of wealth creation, and the sense of security that comes with rising portfolios creates an environment where optimism reigns supreme. However, amid this bullish enthusiasm, it is crucial to remember one fundamental truth: markets do not move in a straight line. Corrections are an inevitable part of every bull run and understanding this concept can be the key to navigating the market with confidence and foresight.

The Nature of Bull Markets

A bull market is characterized by a sustained period of rising stock prices, often driven by strong economic fundamentals, investor optimism, and positive market sentiment. During such times, it can be easy to assume that the market will continue its upward trajectory indefinitely. However, history has shown us time and again that this is not the case.

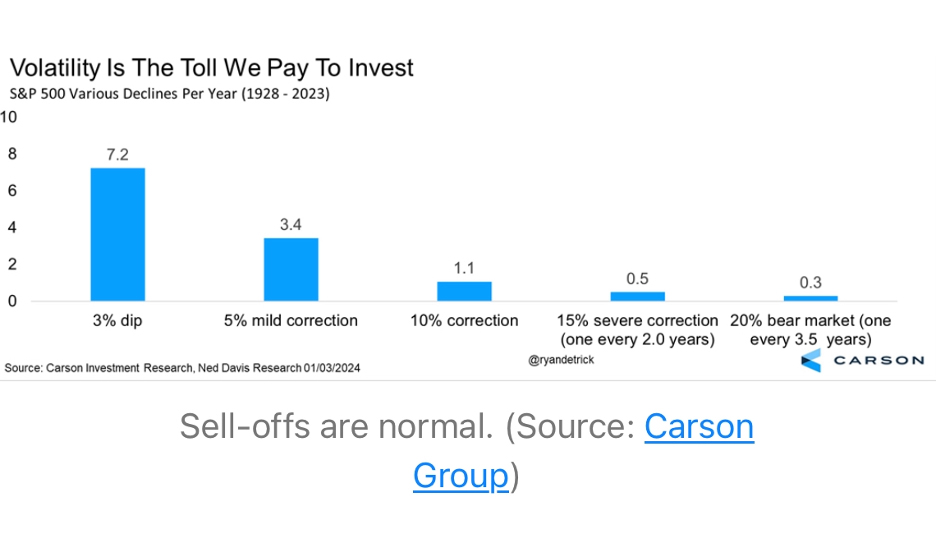

Every bull market, regardless of its strength or duration, experiences periods of correction—short-term declines in stock prices that can range from a few percentage points to more substantial drops. These corrections are not signs of a failing market or a precursor to a bear market; rather, they are natural, healthy adjustments that help maintain the overall integrity of the market.

Understanding Market Corrections:

A market correction is typically defined as a decline of 10% or more in the price of an investment, asset, or index from its most recent peak. Corrections can occur in any asset class, but they are most commonly associated with equities. These downward movements are often triggered by a variety of factors, including changes in economic data, shifts in investor sentiment, geopolitical events, or market speculation.

Corrections serve several essential functions in a bull market:

- Valuation Adjustment: As stock prices rise during a bull run, they can become overvalued relative to their underlying fundamentals. A correction helps bring prices back in line with the true value of the assets, preventing the formation of speculative bubbles.

- Risk Management: Corrections act as a natural mechanism for managing risk in the market. By tempering the pace of price increases, they help to reduce the likelihood of extreme volatility and sharp reversals.

- Investor Discipline: Corrections remind investors of the importance of maintaining discipline in their investment strategies. They encourage investors to reassess their portfolios, ensuring that they are not overexposed to any particular asset class or sector.

- Long-Term Health: Corrections contribute to the long-term health of the market by preventing unsustainable growth. They allow the market to consolidate gains, providing a solid foundation for future advances.

The key point is we want corrections to happen on a regular basis.

The Psychological Impact of Corrections:

While corrections are a normal and necessary part of the market cycle, they can be psychologically challenging for investors. The sudden drop in asset prices can trigger fear, anxiety, and a sense of uncertainty, leading some investors to make hasty decisions that may not align with their long-term financial goals.

One of the most common mistakes during a correction is panic selling—liquidating assets in response to short-term market movements. This reaction is often driven by the fear of further losses, but it can result in missed opportunities for future gains when the market rebounds. The truth is that these declines are always temporary, a point that we tend to forget when we are during a severe correction or even a bear market (a correction of 20% or more).

To navigate corrections successfully, it is essential for investors to maintain a long-term perspective and avoid being swayed by short-term market noise. This means focusing on the underlying fundamentals of their investments, rather than being overly concerned with day-to-day price fluctuations.

Historical Perspective: Corrections in Previous Bull Markets:

Looking at past bull markets can provide valuable insights into the role of corrections and their impact on long-term investment performance. History shows that corrections are not only common but also present opportunities for investors who remain patient and disciplined.

For example, during the bull market of the 1980s and 1990s, there were several notable corrections, including the 1987 stock market crash, where the Dow Jones Industrial Average (DJIA) plunged by 22.6% in a single day. Despite this dramatic decline, the market recovered relatively quickly, and the bull market continued for several more years, culminating in the tech boom of the late 1990s.

Similarly, the bull market that followed the 2008 financial crisis experienced multiple corrections, including a significant downturn in 2011 when the U.S. credit rating was downgraded. Despite these setbacks, the market rebounded and continued its upward trajectory, delivering substantial returns to investors who stayed the course.

When it comes to the Sensex, there has been 1 or more 10% correction every year since 1980. Despite this, the Sensex has been up in 34 years out of 45 (76% of the time) with strong double digit returns in 27 of those years (60% of the time).

These examples and data points highlight an important lesson: corrections are temporary setbacks in the broader context of a bull market. While they may cause short-term pain, they do not derail the long-term growth potential of the market.

This brings me to two important points. Corrections are normal, and Corrections are necessary.

Strategies for Navigating Corrections:

To successfully navigate corrections and capitalize on the opportunities they present, you should consider the following strategies:

- Stay the Course: Maintain a long-term perspective and resist the urge to make impulsive decisions based on short-term market movements. Remember that corrections are a normal part of the market cycle and that the market has historically rebounded from these periods of decline.

- Review Your Portfolio: Use corrections as an opportunity to review your portfolio and assess your asset allocation. Ensure that your portfolio is diversified across different asset classes and sectors, reducing your exposure to any single investment.

- Focus on Fundamentals: Pay attention to the underlying fundamentals of your investments, such as earnings, revenue growth, and market position. Avoid being swayed by market speculation or short-term trends that may not reflect the true value of your assets.

- Continue your SIPs: If you have a long-term investment horizon, practice rupee-cost averaging (through Systematic Investment Plans)—a strategy where you invest a fixed amount of money at regular intervals, regardless of market conditions. This approach allows you to buy more units when prices are low, potentially enhancing your returns over time.

- Rebalance Your Portfolio: Corrections can cause your asset allocation to drift from your target allocation. Rebalancing your portfolio ensures that it remains aligned with your risk tolerance and investment goals.

- Seek Professional Guidance: If you are unsure how to navigate a correction or if you are concerned about your portfolio, seek guidance from your real financial professional (or your financial coach). She/he will guide you based on your individual circumstances and help you stay on track toward your long-term financial goals.

Embracing Corrections as Opportunities:

Rather than fearing corrections, you should embrace them as opportunities to strengthen your portfolios and reinforce your investment strategy. By maintaining a disciplined approach and focusing on long-term goals, you can use corrections to your advantage, positioning yourself for success in the ongoing bull market.

While market corrections can be unsettling, they are an integral part of every bull run.

Understanding their role in the market and adopting a long-term perspective can help you navigate these periods of volatility with confidence.

By staying the course, focusing on fundamentals, and embracing corrections as opportunities, you can continue to build wealth and achieve your financial goals, even in the face of short-term market fluctuations.

Remember, investing is a marathon, not a sprint. The road to financial success is paved with ups and downs, but those who remain patient and disciplined are ultimately rewarded.

The question then is – will you be rewarded?

and then tap on

and then tap on

0 Comments