This Matters More Than Brilliance

Rahul had tried everything.

Keto, intermittent fasting, high protein, juice cleanses. You name the diet, he had been on it. Some worked for a while. He lost weight, felt better, and believed he had finally cracked the code. But then the old habits returned. Midnight snacking. Skipping workouts. Finding excuses when life got busy. Slowly, the weight came back.

He then decided to go all in. He hired one of the best fitness trainers in the city. He consulted a dietitian with impeccable credentials. He paid for premium gym memberships and subscribed to fitness apps. For a few months, the results showed. The weight dropped again. The energy was back. The system looked perfect on paper.

But then, behavior kicked in again. He slipped back into his old ways. The plans were brilliant. The experts were world class. But none of it mattered. Because Rahul’s behavior did not change.

The same is true in money.

You may work with the finest financial professional in the world. You may hold a portfolio designed with the best research, the right mix of investments, and the perfect plan for your future. But if you do not behave, none of it matters.

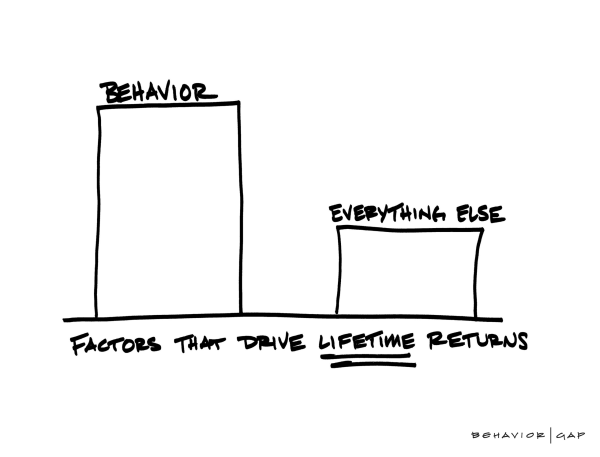

Because wealth is not only about markets. It is about behavior.

History proves this again and again. The biggest mistakes investors make are not technical errors. They are behavioral ones. Selling in panic. Buying in euphoria. Chasing fads. Refusing to plan. Ignoring discipline. These decisions, made in moments of emotion, destroy more wealth than any poor stock pick ever will.

Think about the person who sells everything in a downturn because fear takes over. Their portfolio may have been perfect on paper. But behavior turned it into dust. Or the person who cannot resist chasing the next hot product. Their plan may have been rock solid. But behavior derailed it.

Money has always been emotional. Fear and greed pull harder than logic and numbers. Discipline feels boring compared to the thrill of a quick win. Long-term patience feels frustrating when the world is screaming about short-term moves. And yet, these emotional traps are exactly where fortunes are lost.

This is why your behavior matters more than the brilliance of your financial professional.

The best financial professional can design strategies. They can educate you. They can guide you. But they cannot control your actions. That choice is always yours. Just as the best doctor cannot stop you from eating junk food. Just as the best trainer cannot force you to show up at the gym.

Your role as an investor is not passive. It is active. It is to behave in ways that give your money the time and space to grow. It is to resist impulses that destroy compounding. It is to trust the process even when emotions scream otherwise.

Behavior is not about perfection. You do not have to be flawless. You do not have to predict the market. You do not have to beat everyone else. You only have to avoid the big mistakes.

Think about health again. If Rahul simply ate reasonably, moved daily, and avoided extremes, he would have been in far better shape. Not perfect. But healthy. The same applies to you. If you invest reasonably, stay disciplined, and avoid panic-driven mistakes, you will likely succeed. Not perfect. But wealthy enough to live with peace of mind.

The challenge is not knowing this. Most people know it. The challenge is doing it consistently.

Because doing requires patience. It requires the humility to stay the course when others are shouting for action. It requires the ability to sit still when noise tempts you to move. It requires trust.

This is where a financial professional plays an important role. Not by predicting markets. Not by chasing products. But by helping you manage behavior. By being the voice of reason when your emotions scream for action. By reminding you of your goals when fear or greed takes over. By helping you pause when you want to react.

But even the best financial professional cannot do this without your cooperation. They can guide. They can nudge. They can coach. But you must choose to listen. You must choose to behave.

This is the real partnership in money. Your financial professional brings knowledge, process, and discipline. You bring behavior. Both must work together. If either side fails, the plan fails.

Let us be clear. Money is not only about numbers. It is about psychology. It is about patience. It is about choices you make repeatedly over years. The numbers only work if you behave.

This truth may feel simple, but it is not easy. That is why so many people with perfect portfolios still fail. That is why people with great financial professionals still sabotage themselves. The missing link is behavior.

The good news is that behavior can be learned. Just as you can train yourself to exercise, you can train yourself to act wisely with money. Start small. Notice your impulses. Pause before making big decisions. Ask questions before reacting. Trust the long-term over the short-term.

Every time you practice this, you build the muscle of discipline. Over time, this muscle protects you more than any fund, any portfolio, or any prediction ever could.

The world will always be noisy. Markets will always fluctuate. People will always promote the next idea. But if you behave, you will not be shaken. You will stay the course. You will give compounding the time it needs. You will create wealth that lasts.

It is not about the best financial professional. It is about the best behavior.

Just as Rahul learned, no coach or dietitian can save you if you refuse to behave. In money, no portfolio or financial professional can save you if you refuse to behave.

In health, you cannot outsource discipline. In wealth, you cannot outsource behavior.

The portfolio may be brilliant. The professional may be world class. But in the end, your future will be shaped by one thing.

Your behavior.

And the best behavior is simple. Stay invested. Stay disciplined. Align money with what matters most to you. Avoid the big mistakes. Let time do the work.

Choose to behave.

and then tap on

and then tap on

0 Comments