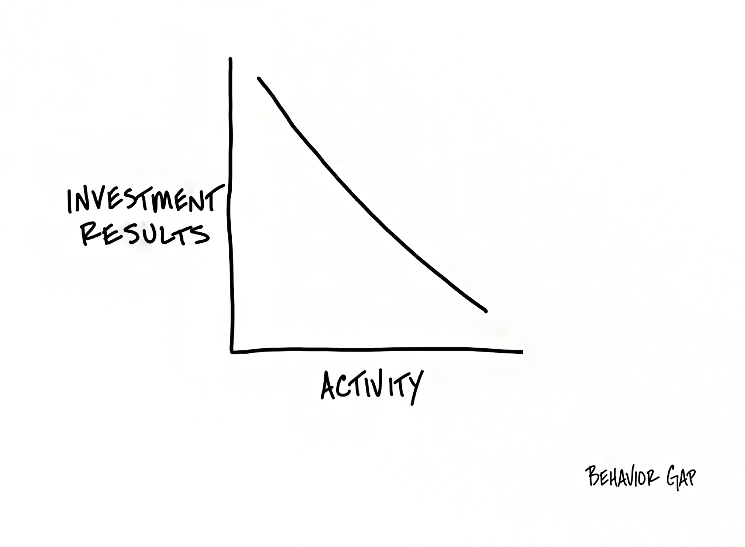

Activity versus Investment Results

When done correctly, investing is one of the few areas in life where you get rewarded for being lazy. By lazy, I don’t mean careless or ignorant. I mean making fewer, better decisions and letting those decisions play out over time.

This may feel counterintuitive. From a young age, we are taught that doing more leads to better results. More hours in the office means more output. More studying means better grades. More effort usually equals more reward. So naturally, investors believe that more trading, more activity, and more tinkering will lead to better performance.

But investing works differently. Investing is a do-less proposition because of the power of compounding.Compounding rewards patience, not activity. It multiplies quietly in the background, provided you leave it alone. The moment you keep interfering; you interrupt the very force that builds wealth.

Think of a tree. Once you plant it, your job is not to keep pulling it out of the soil to check if it has grown. Your job is to water it, protect it, and then let it grow. The more you interfere, the more you stunt its growth. Investments are no different.

The next time you are tempted to do something because the markets are moving or the news cycle is noisy, pause. Remind yourself that often the best decision is no decision. If it compounds, let it.

True investing discipline lies not in constant activity but in the strength to stay still. That stillness is not inaction. It is wisdom. It is understanding that wealth is not built by chasing every opportunity, but by holding firmly to the right ones.

In investing, doing less is often the smartest thing you can do. And over time, it is the only way to let compounding do its quiet magic.

and then tap on

and then tap on

0 Comments