No Portfolio Can Change This

@newhappyco

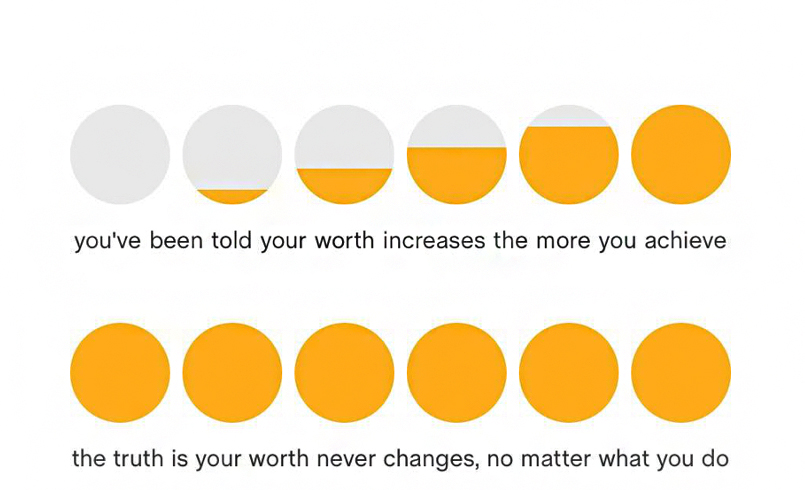

From a very young age, most of us are conditioned to believe that our worth is tied to our achievements. We are told that the more we accomplish, the more valuable we become. Good grades make us worthy of praise. Winning awards makes us worthy of admiration. Climbing the career ladder makes us worthy of respect. Building wealth makes us worthy of recognition. The world constantly reinforces this idea that worth is something you earn, something you must keep proving.

This mindset naturally carries into the way we approach investing and money. Many investors unconsciously tie their self-worth to their portfolio’s performance. When markets rise, they feel intelligent and successful. When markets fall, they feel inadequate, sometimes even ashamed. They look at the numbers and believe that the numbers are a reflection of them. But numbers are not identity. Numbers are not worth.

The truth, as the visual above beautifully puts it, is that your worth never changes, no matter what you do. Your value as a human being is not contingent on your returns. It is not contingent on the size of your portfolio. It is not contingent on whether you beat an index or achieved a certain target in a given year. These are external markers. They may fluctuate daily, monthly, or yearly, but your intrinsic worth does not.

Yet, many investors fall into the trap of chasing achievements in investing as though they are chasing worth. They want to beat the market because they think it proves something about them. They want to own certain products because it signals status. They want to boast about short-term gains because it provides validation.

When investing becomes about proving your value, you lose sight of the real purpose of money. Money is meant to be a tool to help you live the life you want. It is not meant to become the scoreboard of your identity.

Think about this. If your portfolio drops by 10 percent, does your worth as a parent change? Does your worth as a spouse or a friend change? Does your worth as a human being who can show kindness, love, and integrity change?

Of course not. Yet we behave as if it does.

We allow temporary fluctuations in wealth to affect how we feel about ourselves. This is the danger of conflating self-worth with net worth.

This belief also drives destructive behaviors. When self-worth is tied to performance, investors chase quick wins. They panic in downturns because a decline in the market feels like a personal failure. They overtrade, overleverage, and overreact. They focus on appearing successful rather than being secure. They forget that wealth is not about comparison, it is about alignment with personal values and goals.

Understanding that your worth never changes liberates you from this cycle. It allows you to invest with perspective. It allows you to stop seeking validation in numbers and start seeking meaning in outcomes.

It allows you to ask different questions: Am I using my money in ways that bring me joy? Am I aligned with what matters most to me? Am I creating a financial life that supports my well-being and my family’s well-being? These are the real questions that define a successful investor.

Investing becomes far healthier when it is disconnected from the idea of proving worth. It becomes about stewardship rather than competition. It becomes about making decisions that serve your future rather than impressing others in the present. It becomes about patience and discipline rather than ego and impulse.

The irony is that the best investing results often come when you stop trying to prove yourself. When you let go of the need to outperform, you focus on what you can control: asset allocation, diversification, costs, behavior. You stay disciplined because your ego is not on the line. You accept underperformance in certain periods because you know your worth is not being judged. You avoid panic because you know a temporary decline is not a reflection of who you are. This mindset shift often leads to better financial results precisely because you are no longer enslaved by them.

This is not easy. The world constantly shouts the opposite message. Social media glorifies wealth displays. The industry glorifies beating benchmarks. Friends and peers brag about returns, making you feel less if you did not match them.

Everything around you pushes you to believe that your worth is measured by numbers. But if you are to be a successful long-term investor, you must resist this. You must remember that worth is intrinsic, not extrinsic.

When you internalize this truth, you also gain resilience. Market downturns become less emotionally destabilizing. They are just part of the process, not a verdict on you. Underperformance in a product or strategy becomes an opportunity to learn, not a mark of incompetence. You stop comparing your results to everyone else’s and start focusing on your own journey. That is where peace lies.

Investors who understand this truth also pass on something priceless to their families. They teach their children that money is important but it does not define them. They show by example that setbacks are temporary and do not reduce who you are. They help create a healthier relationship with money for the next generation.

Your worth is constant. It does not increase when your wealth grows and it does not decrease when your wealth shrinks. You were worthy yesterday. You are worthy today. You will be worthy tomorrow. No portfolio statement can ever change that.

Invest wisely. Build wealth with discipline. Use it to live a life of purpose. But never make the mistake of equating your net worth with your self-worth. Because your worth is not up for debate. It is not variable. It is not negotiable.

The numbers will go up and down. Your true worth never will.

and then tap on

and then tap on

0 Comments